The Smart Investor’s Guide to Land Investing: Pros, Cons & How to Profit

Featured

Sell Land Faster with These EIGHT Effective Property Listing Strategies

How To Pull Property Records With The Land Portal (Step-by-Step)

The Best Land Flipping Lead Generation Strategy of 2024

The Smart Investor’s Guide to Land Investing: Pros, Cons & How to Profit

How to Get Started In Real Estate Investing With No Money

The Smart Investor’s Guide to Land Investing: Pros, Cons & How to Profit

Join our free Discord channel!

Engage & network with thousands of new and experienced investors, participate in weekly deal reviews, and more!JOIN

When it comes to wealth-building strategies, real estate has always been a top choice.

But while most people focus on houses, apartments, and commercial buildings, savvy investors turn to an often-overlooked asset: raw land.

Land investing is gaining momentum as an attractive investment because of its high returns, low maintenance, and versatility. However, like any investment, it has its risks.

If you’re looking to build financial freedom through land flipping, this guide breaks down everything you need to know about the pros and cons of land investing—and why it might just be the best investment decision you ever make.

Why Land Investing is a Game Changer

Raw land is exactly what it sounds like—undeveloped property with no structures, utilities, or significant improvements. While that may not sound exciting at first, it’s actually what makes land such a powerful investment.

Unlike houses or commercial buildings, land is a blank slate. You can flip it, lease it, develop it, or simply hold onto it while it appreciates in value.

But what makes land such a valuable investment?

-

Limited Supply, Increasing Demand – The world isn’t making more land, but the population is growing. That means land will always be in demand, and its value will continue to rise over time.

-

Low Maintenance & Holding Costs – Unlike rental properties that require upkeep, land has minimal carrying costs. No tenants, no repairs, no property management headaches.

-

Flexibility & High-Profit Potential – Whether you choose to sell as-is, subdivide, or develop, land offers multiple paths to profitability.

- Less Competition – While traditional real estate markets are flooded with investors, land investing remains a niche with fewer competitors, giving you more opportunities to find great deals.

How Does Land Appreciate?

One of the biggest advantages of land investing is appreciation. The basic economic principle of supply and demand plays a major role here: land is a finite resource, but its demand increases as populations expand.

Here’s why land appreciates in value:

-

Infrastructure Development – When new roads, utilities, or zoning changes occur near your property, land values skyrocket.

-

Market Growth – As cities expand outward, raw land in once-rural areas becomes prime real estate for future development.

-

Scarcity – Over time, available land decreases, making the remaining plots more valuable.

By holding onto land in a growing area, investors can generate significant returns without lifting a finger.

The PROS of Land Investing

1. Simplicity & Low Maintenance

Unlike traditional real estate, land requires no repairs, no renovations, and no tenants. There’s no need to worry about structural damage, plumbing issues, or HVAC failures.

You simply buy and hold while it appreciates or flip it for a quick profit.

2. High ROI with Low Entry Costs

While buying a house requires a significant down payment and financing, you can purchase land for a fraction of the cost—sometimes even for just a few thousand dollars. Since land is often undervalued, finding great deals is easier than in other real estate sectors.

3. No Depreciation

Unlike buildings that deteriorate over time, land does not depreciate. It remains in its natural state and often appreciates, especially in growing areas.

4. No Tenant or Management Hassles

Land investing removes the stress of dealing with renters, late payments, or property management companies. This makes it a passive investment that fits well into a long-term wealth-building strategy.

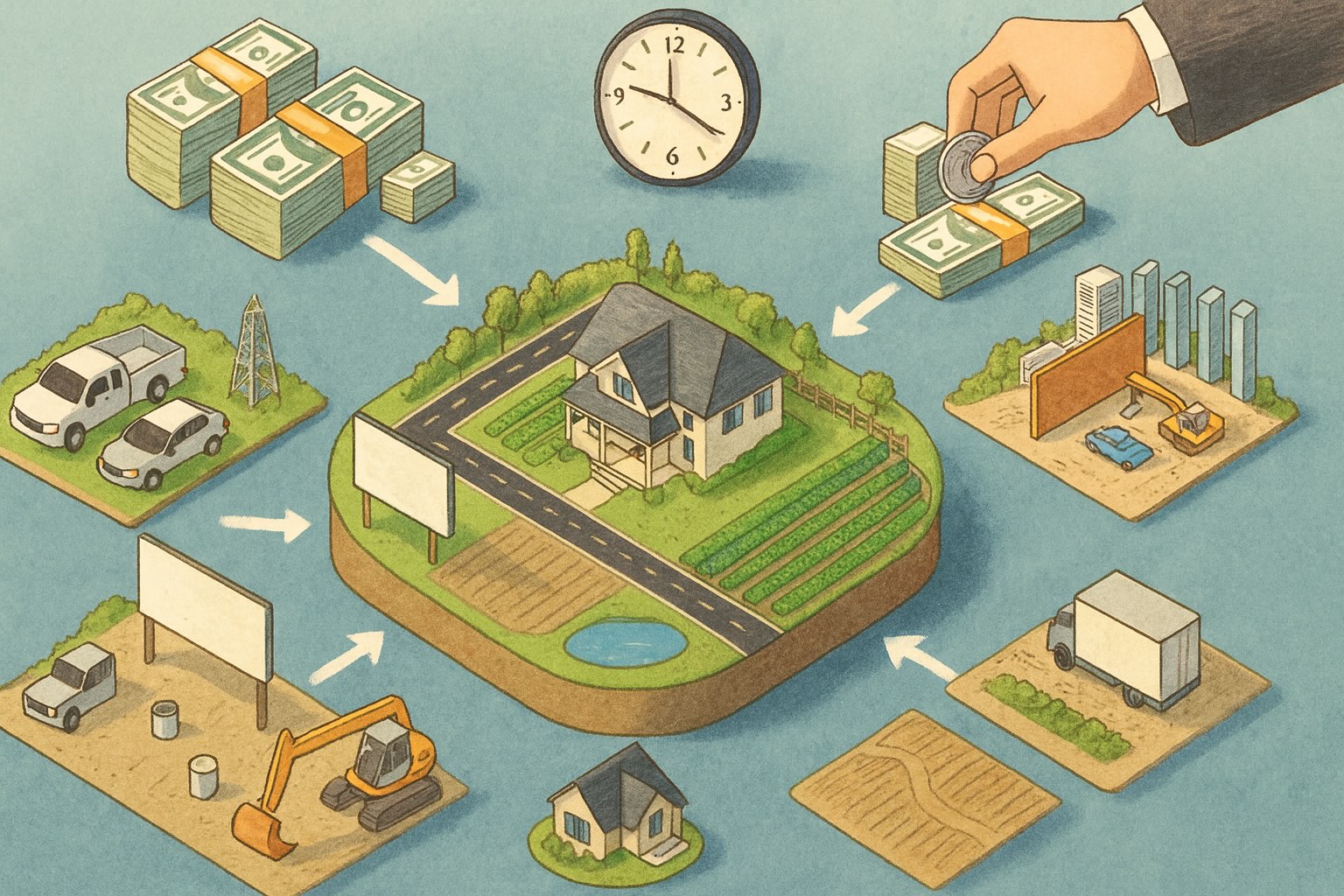

5. Multiple Exit Strategies

One of the most exciting aspects of land investing is the variety of ways to profit. Here are just a few:

- Flipping – Buy " target="_blank" rel="noopener">undervalued land and resell it at a higher price.

- Subdivision – Split a larger parcel into smaller lots for higher per-unit sales.

- Leasing – Rent the land for farming, billboards, cell towers, or parking.

-

Development – Build homes, commercial buildings, or storage facilities.

The options are endless, and investors can choose the strategy that aligns with their goals.

The CONS of Land Investing

While land investing has many advantages, it’s important to be aware of potential downsides.

1. Liquidity Concerns

Unlike stocks or mutual funds that can be sold instantly, selling land may take time. Finding the right buyer can be challenging, especially in rural areas with less demand.

2. Zoning & Legal Restrictions

Each property has specific zoning laws dictating how it can be used. Some land may have restrictions on development, while others might require expensive permits. Doing thorough research before purchasing is crucial.

3. Encroachments & Legal Disputes

Land is prone to disputes over property lines, easements, and encroachments. If a neighbor builds onto your property, resolving the issue can be costly and time-consuming.

4. Limited Cash Flow

Unlike rental properties that generate monthly income, land often requires a longer holding period before turning a profit. However, strategies like double-closing or subdividing can create quicker cash flow.

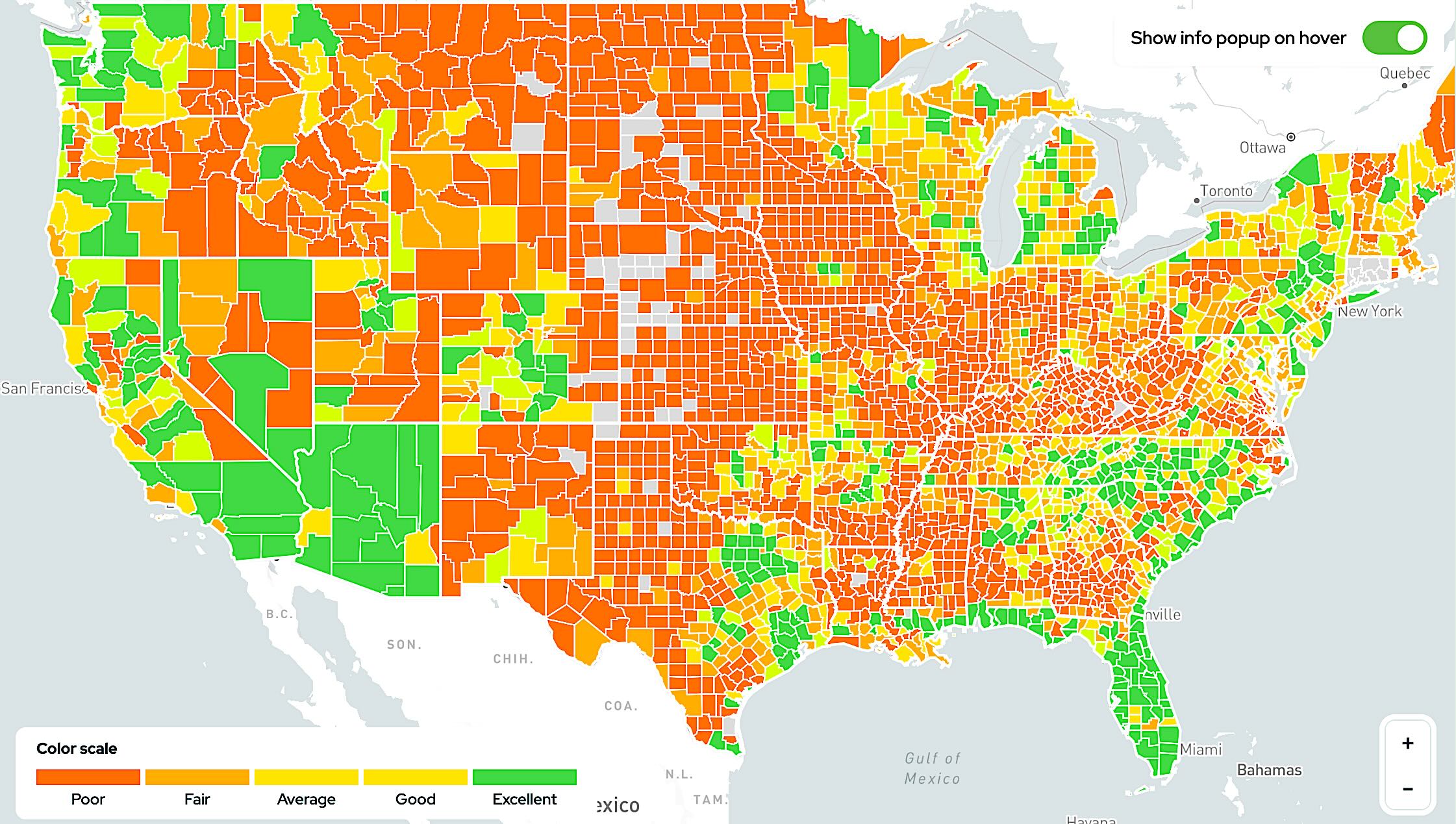

How to Make Smart Land Investments

1. Do Your Research

Successful land investors research market trends, zoning laws, and development potential before buying.

Look for areas with:

✔️ Growing populations

✔️ Infrastructure projects (roads, highways, schools)

✔️ Favorable zoning laws

✔️ High demand and limited supply

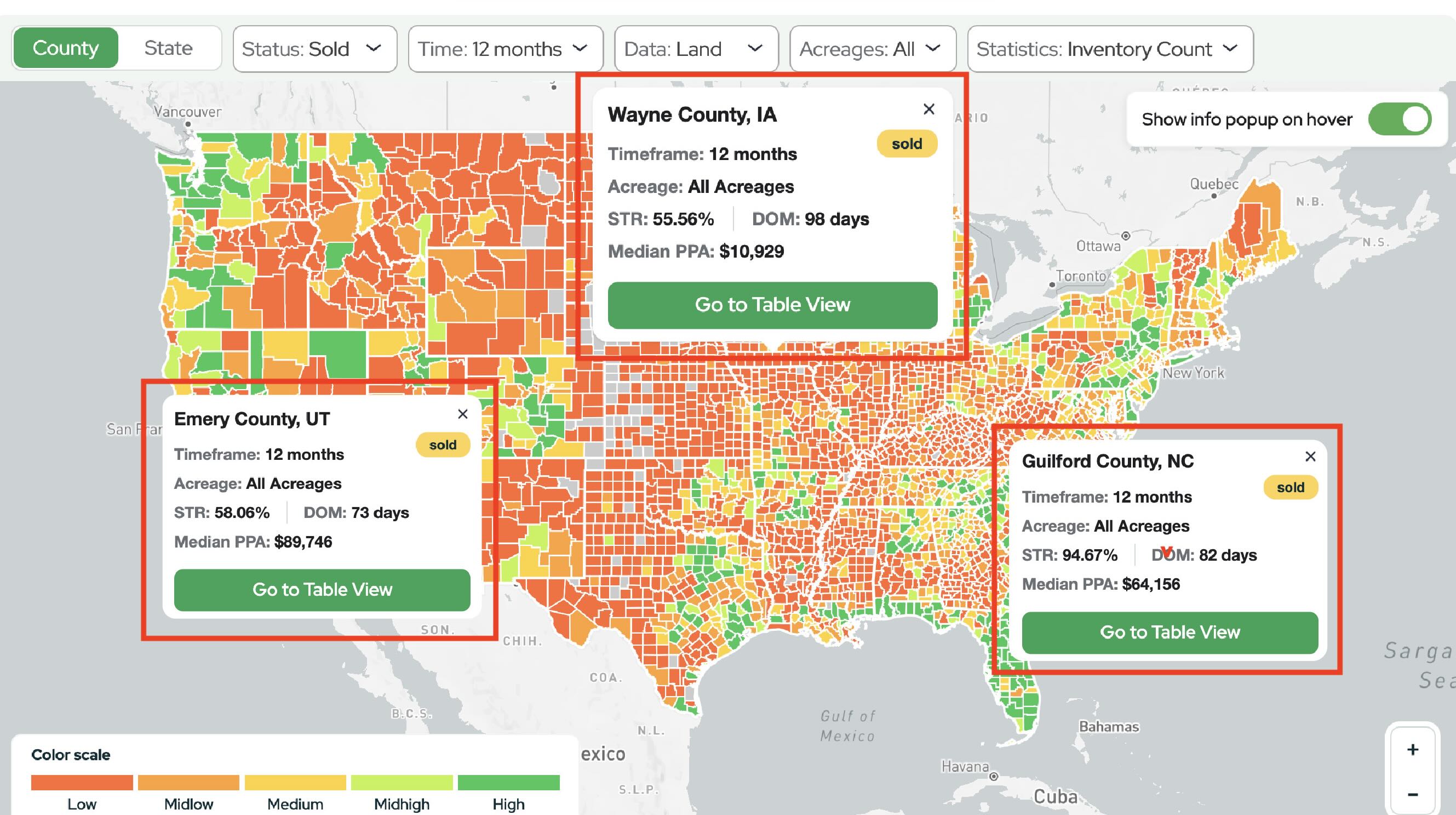

2. Use Data-Driven Tools

Platforms like The Land Portal provide insights into land values, ownership records, and market trends, helping investors make informed decisions.

3. Buy at the Right Price

The key to land flipping is buying at 30-40% below market value. Look for motivated sellers, tax-delinquent properties, and foreclosure auctions to secure deals.

4. Have an Exit Strategy

Before buying, consider how you’ll profit. Will you flip, develop, or lease? Having a plan ensures you maximize your returns.

5. Stay Educated

The most successful investors continuously learn. Follow industry experts, take courses, and connect with experienced land investors.

Final Thoughts: Is Land Investing Right for You?

Land investing is one of the most underrated wealth-building strategies available today. It’s simple, low-maintenance, and highly profitable for those who do their research.

Whether you're looking to build long-term wealth or make quick profits through flipping, investing in land offers an incredible opportunity for financial freedom.

If you're ready to take the first step, start exploring available properties and learning from seasoned investors.

The world of land investing is wide open—and the next great opportunity is waiting for you. ?

Listen to the Latest Podcast

Watch the Full Episode Here

https://youtu.be/ttpVwFD6dmQ