TOP 3 AI Tools Every Land Investor Needs To Be Using on The Land Portal

Top 3 AI Tools Every Land Investor Needs to be Using on The Land Portal

Featured

Leaving Corporate America to Travel the World w/ Brian Luebben

September 21, 2023Save Time & Make More Money as an Entrepreneur (5 STEPS)

January 17, 2024How AI is Revolutionizing the Real Estate Industry

August 23, 2023How to Find, Avoid or Sell Wetland Properties

January 10, 2024If I Wanted to Make $10K FAST Flipping Land, Here’s What I’d Do

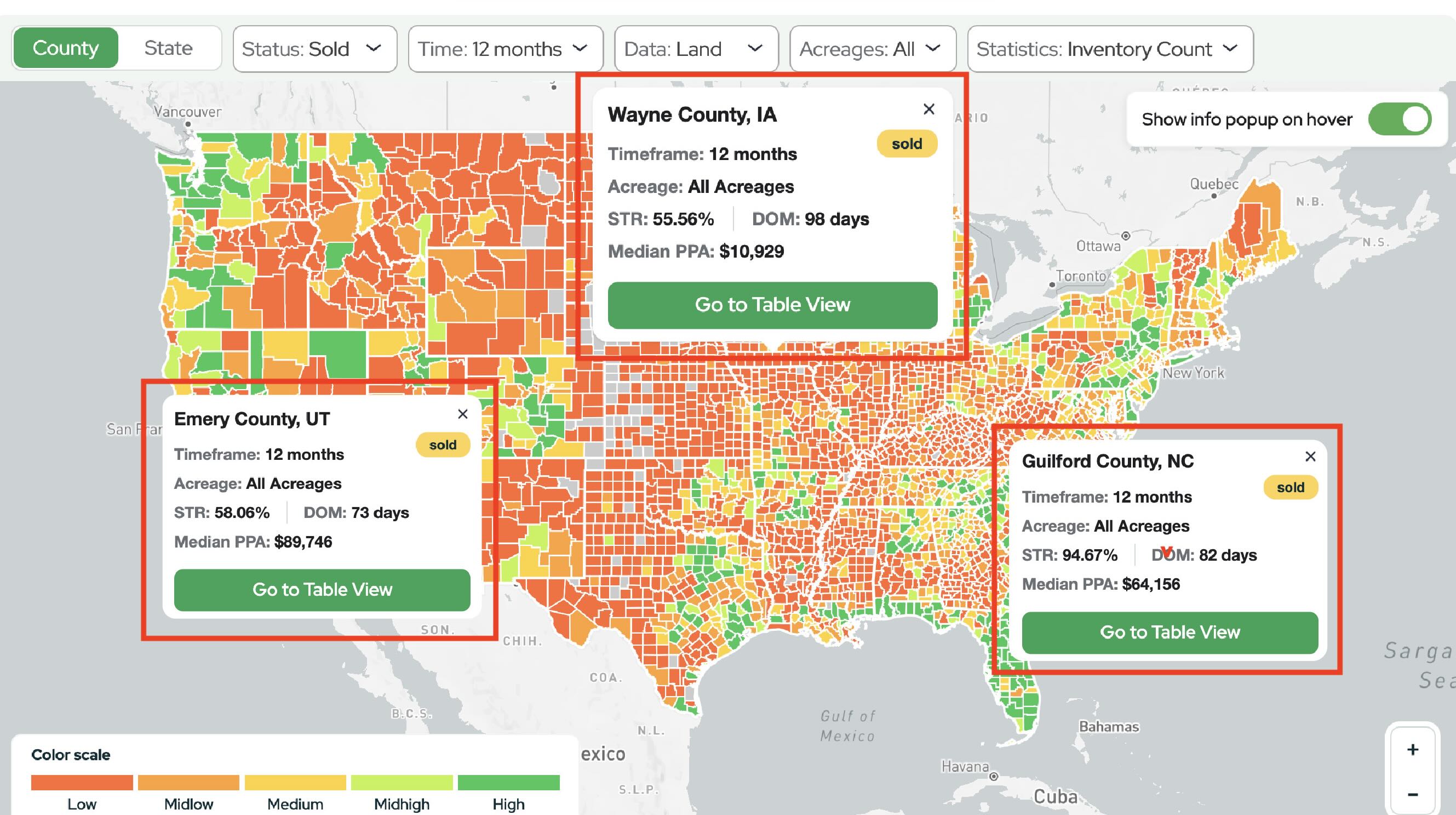

January 24, 2025Today, we’re diving into three powerful AI tools available on The Land Portal that can drastically improve your land data pulls, allowing you to eliminate bad land and make smarter investment decisions.

Accurate data is a cornerstone of land investing, and these tools will help you target properties with the potential for high returns while filtering out unsuitable ones.

Whether it’s avoiding landlocked properties, ensuring ample road frontage, or mitigating wetland risks, The Land Portal’s AI tools are essential for any land investor.

1. Filter Out Landlocked Properties

One of the biggest red flags when pulling land data is a landlocked property—land with no road access. Without road frontage, the property’s value diminishes significantly, making it hard to sell or develop.

Luckily, The Land Portal has an AI-powered feature that helps you eliminate these undesirable properties. Here’s how to use it:

Join our free Discord channel!

Engage & network with thousands of new and experienced investors, participate in weekly deal reviews, and more!JOIN

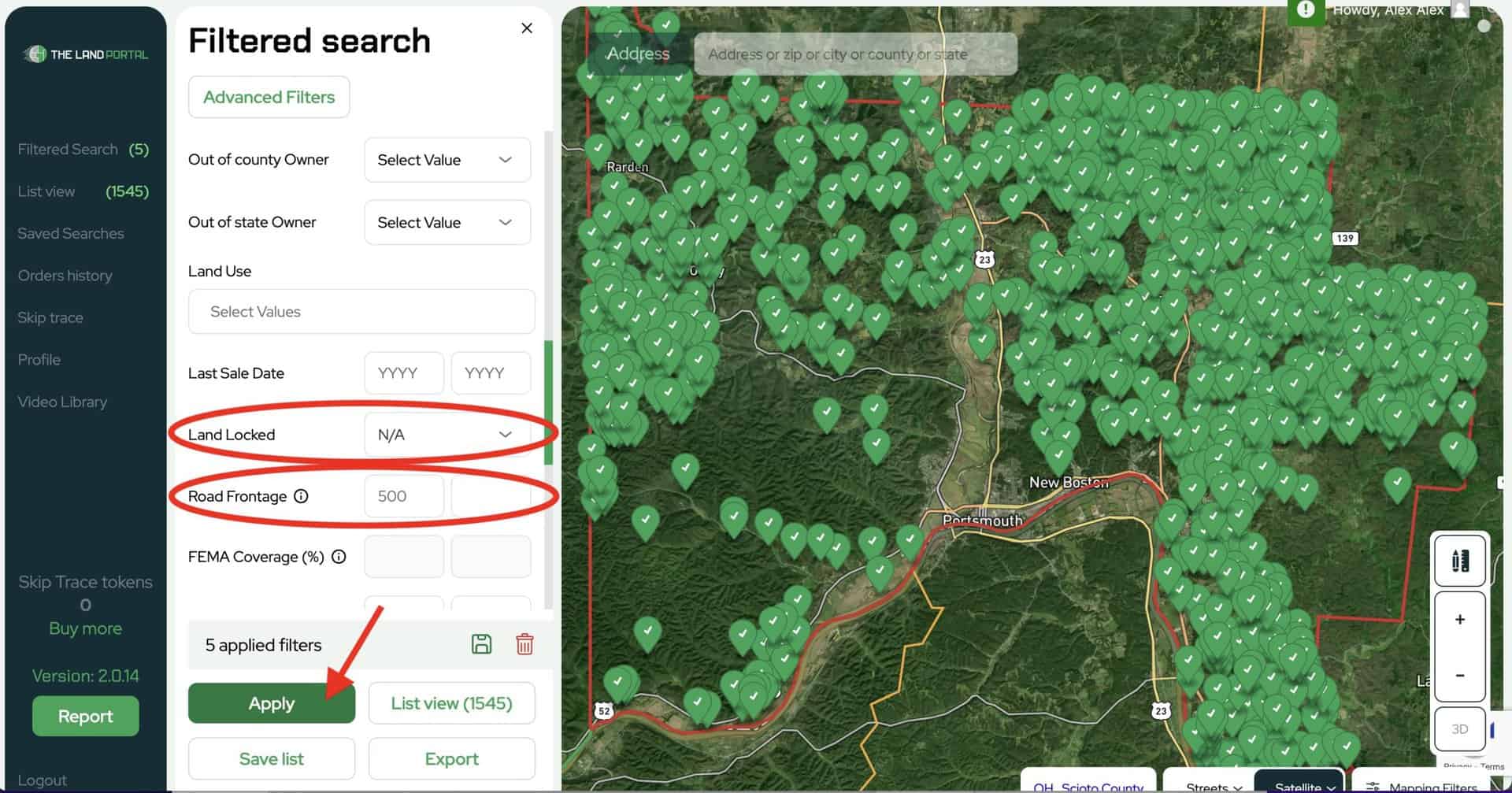

Start by selecting your desired county. For example, let’s choose Scioto County, Ohio, and filter our search for properties over 30 acres.

You will see a lot of properties show up on your map, but we don't necessarily need all of them.

To narrow your search to only properties with road access, switch the Landlocked filter to "No" and click Apply.

This will eliminate any landlocked properties from your list and leave you with parcels that are accessible via public or private roads.

As a result, you’ll only be working with properties with higher potential value.

This simple AI feature can save you hours of manual research and ensure that your investments won’t be hindered by lack of access.

2. Maximizing Potential with Road Frontage

Road frontage is a key factor in determining a property’s subdividing potential. Larger frontage opens up opportunities for multiple access points, making properties ideal for subdivision.

The AI tool on The Land Portal allows you to filter properties based on the amount of road frontage, ensuring that you only invest in properties with high development potential.

Road frontage is a key factor in determining a property’s subdividing potential. Larger frontage opens up opportunities for multiple access points, making properties ideal for subdivision.

The AI tool on The Land Portal allows you to filter properties based on the amount of road frontage, ensuring that you only invest in properties with high development potential.

After filtering out landlocked properties, head back to the search and select “Road Frontage”.

Let’s say you’re interested in properties with over 500 feet of road frontage, ideal for subdivision plays.

Go back to your Filtered Search and change Land Locked to and Road Frontage to 500.

If you want to further refine your list, try increasing the road frontage to 1,000 feet or more. This will leave you with 43 high-quality properties, perfect for development or resale.

After refining your results, zoom in on a parcel to see the road frontage.

Clicking on the property will provide a lot of great information including the exact road frontage.

You can see in our example below, this property has 1,257.62 ft of road frontage; a great property for land flipping or subdividing

3. Minimizing Risk with Wetlands Analysis

Investing in wetlands can be tricky. In regions like Florida, where wetlands are prevalent, buying land with high wetland coverage can reduce a property’s value and usability.

The AI tool on The Land Portal lets you filter properties based on their percentage of wetland coverage, saving you from purchasing land with limited usability.

For the sake of this walkthrough, first change the state to Florida, focusing on a wet region like Nassau County and select properties between 10-30 acres and click Apply.

Once you have the area pulled up on your map, zoom in so you can see the land a little better.

Next we are going to click on Mapping Filters in the bottom right corner of the map and select the Wetlands Coverage filter. If you want to avoid properties heavily impacted by wetlands, set the filter to show 0-50% wetlands.

This filter allows you to find properties that have minimal wetland interference, making them more suitable for development. You can also raise or lower the wetlands percentage based on your preferences.

Let's narrow down our results even further.

Go back over to the Filtered Search and select properties between 10-30 acres.

Next, scroll down until you see "Wetlands Coverage". If you want to avoid properties heavily impacted by wetlands, set the filter to show 0-50% wetlands.

This filter allows you to find properties that have minimal wetland interference, making them more suitable for development. You can also raise or lower the wetlands percentage based on your preferences or the size of land you're looking for.

These three AI features—landlocked filter, road frontage filter, and wetlands analysis—are essential tools for any serious land investor.

By using The Land Portal’s AI capabilities, you can streamline your data pulling process, avoid costly mistakes, and maximize the potential of every property you consider.

If you’re not already a member of The Land Portal, don’t miss out on your 14-day free trial!

Watch our full walkthrough of these 3 amazing AI tools in the video below! ⬇️

Curious about buying land but don't have the capital? ?

Bring us a great deal and we will fund it for you! Fill out the form HERE to get started. Our team will review your deal and get back to you within 24 hours!

Listen to the Latest Podcast

View Transcript here

Ron: Welcome back to the real estate investing podcast. I’m your host by myself today, Ron Apke. Excited to talk about this topic. And the title that I named this is you’re just getting started in land flipping. How much money do you need? And the reason I’m I chose this title was more so because how often we get asked this question.

So many people come into this business are interested in coming into this business and they are interested. Like how much money do they need to get started? How much does the average person, if I start with 2000, I started at 4, 000, I started 10, 000. What is the upside on that money that I am putting in?

It is. Probably from people who are not in land flipping yet, it is probably the number one most common question. Uh, I don’t know if it’s a number one thing for getting people to not take action, but it probably is as far as just being willing to invest everything like that. You do obviously need some money to invest to get started in this business.

But let’s get started. The first thing, or there’s some, there’s so many topics that go under this. And for someone to ask me how much money do they need to get into this business without knowing the background, without knowing everything else on their situation, uh, Uh, I can give them, I can give you guys estimates.

I can give you guys what the normal person starts with, but there’s also been people on both sides of the spectrum. We’ve had people who have started with three, four, 500, um, of marketing money and they have just killed it off to start. Am I going to tell everyone like you only need 500? No, but there are situations, there’s outliers for sure on both ends.

There’s people who come in with 20, 30, 000 and they’re ready to roll. Uh, they’re ready to invest in people that are ready to scale their business. Yeah. But the first thing when you are coming into this business is you need to decide based on you, like it’s not based on what I’m telling you. It’s not based on what someone else is telling you.

How much risk are you willing to put forward? Essentially, like what is your, uh, What’s your relationship with risk in general? Some people are much more cautious and risk adverse, and they don’t really much want, want much risk in their life. So they might only be willing to put in 10 percent of what their savings are, or something like that, into a business like this, other people.

Uh, we’ve had people who have come in who have taken out credit card debt and taken out all these different things. And they, their mindset was the biggest thing with it because they didn’t take out credit card debt and like, think like I’m going to lose all this. It was a mindset like this is, they’d never viewed it as risk.

And that was with those situations, like you need to, if you’re scared and you’re doing things like that, you’re going to fail. But if you’re confident and you’re moving forward and you’re willing. To take on something as risky as credit card debt, go for it, but. You as a person, you, you talking with your family, everything like that.

You need to decide like how much risk, look at your bank account. If you have 15, 000, how much are you of that? Are you willing to put it in? If it’s 3000 great, if it’s 5, 000 great, but you really, really do want a number. Can that number change over time? Absolutely. But you really want a number when you’re going in, like, and it’s for both ends of the spectrum too.

It’s so you can’t lose your shirt. And it’s also so you can’t back out early. So if I’m going into something and I’m willing to put 10, 000 into it, I’m spending two, 3, 000 every month. I’m not going to quit after the first month, unless I lose all that money. And I don’t feel like I can scale whatever it is.

Like I’m keep on moving forward that 10, 000. I kind of treat when I first put it in as like that money’s gone. And I’m trying to grow that for whatever endeavor it is, whether it’s land flipping or something else. The next thing you need to look at, and I’m kind of going out of order probably with these things.

But one of the things you want to look at is how much additional money can you put in monthly? So let’s say you have 3, 000. You’re ready to go right now. 3, 000 is probably on the middle to lower end of what we suggest. But if you’re able to put five, 700 additional dollars into the business every month, that is extremely powerful.

It can get you three, four, five months of marketing very, very easily. Get your first, second, third deal. And with that, like we had people who come up with 3, 000 who. are frugal and they are saving money and they want to keep on piling money into this business. They legitimately only have 3, 000 to start, but they know on a monthly basis, they can continue to add more.

That is extremely powerful. And I’ve seen people take that 3000 out another five, 700 every month and take that to a hundred thousand dollars within six months. One of the more important things is when you’re coming in, like, let’s just say you have 20, 000 in your bank. And. You’re like deciding, like, how much do I want to put into this land flipping thing?

I’ve done research. I’ve done education. I understand the potential with this, but again, it’s 20, 000 in your bank. The first thing we talked about was risk. Obviously. Uh, the next thing is like, what are your goals? If you’re trying to quit your job within four or five, six, eight months, it’s very, very realistic.

We have 20, 000 to your name. Again, a lot of it matters on your personal situation. If you’re spending 15, 000 every month, that’s going to be difficult. If you’re spending 2, 500 every month, that’s a lot more attainable. But that being said, if you have 20, 000 and like you are ready to roll, you want to quit your job in six months, you hate your job.

I was in a position. So when I first started land flipping, I mean, I wasn’t making any money. Like I was literally a volunteer basketball coach. Um, I knew I had to make this work or I would have to go get a normal job. And that it was kind of all in with this. I sold off 401k stuff. I sold off assets and.

That was my, I was, I understood the risk. Like I for sure understood that it could go wrong. But that being said, I knew what I didn’t want to do was go work in nine to five was go be a salesperson was go be outside salesperson, whatever the job would have been. I didn’t want to go work for someone else.

And I, Daniel and I saw such a great opportunity in land and within six months, like it was like, yeah, I’m not going to work a job again in my life with how this is going. But You need to look with the money you have, with the money you’re willing to put in. You need to look at like, what are your goals?

If you are trying to do something fast, you need to really, really invest in the business, invest in yourself, invest in marketing. You need to put money into marketing. I’m not saying overdo it. Like if you have 20, 000, do not spend 20, 000 on marketing the first month, but maybe you spend 3, 000 on marketing and go up to 4, 000.

Then five, maybe. And you’re going to be getting deals coming in. It’s going to stack on top of each other. And that is how you quit your job faster. As if you are stacking marketing, text, text, direct mail, all these different things, cold calling. Maybe if you’re stacking these different, different marketing deals are going to stack up and you’re going to have so much, uh, profit by the time you hit six months because how much marketing is out there.

Um, and finally, I kind of want time versus money. So your job matters a lot in this, like if you are working a nine to five job and you can put an hour in a day, it’s a lot different than the person who is maybe working a sales job, but they’re on their own time. They can work three, four hours a day, whatever the number is, those situations are completely different.

You need to keep that in mind when you’re doing these things is what, how much time do you have to invest versus how much money it is very important versus some people come in with so much time, they have hours and hours, they can put it in every day, but they only have a few hundred dollars. So they got to get on the phones, they got a cold call.

And that’s the greatest thing about this business is it really works for both ends of the spectrum. So if you have a bunch of money. 20, 000, 30, 000 to put in this business, but you don’t have a lot of time. You’re probably going to outsource more initially versus you have 500. You have about everyone can scrape up 500 or a thousand dollars.

Um, I, I, in a, in a month, in two months, like you can figure out a way you can go grind. You can go work another job, whatever it is. If you truly want to make it in this business. You can go find 500, 1, 000 to go start pulling some lists, pulling some data, sending some mail, sending, or making some cold calls, all these things.

Cold calling is so, so cheap. It’s such a cheap Avenue of marketing, but it takes a lot of determination, a lot of grind, and it’s a high volume thing. It’s a high time thing. So that is really important. So those are kind of a four main things. Time versus money. What are your goals? How much additional money can you put in monthly?

And how much risk are you okay with? Are you okay with risking everything? Or are you okay with risking 10 percent of what you have? How much you bought into this business? It’s a huge thing. And the most successful people in this business understand all of this when they’re coming in. They not necessarily overanalyze all of this.

But they are educated on what to expect the first three, four months. They’ve listened to podcasts. You guys are listening to a podcast or watch on YouTube, wherever you’re listening and just doing this, like just educating yourself on what to expect. All these different things is so, so important. And those are the people who They know what they want.

They know they want to quit their job in the first six months and they make it happen because they understand the business. Uh, they understand how much money they need to put in to get that result. Overall guys, to answer the question of the day is you are just getting started land flipping. How much money do you need?

We typically tell people 2, 500 to 4, 000 after education costs. So that’s going to be marketing all these different things. Like I said, at the beginning, there are both sides of the spectrum here. There are people who start with three, four or 500 in marketing. They pull some lists, they cold call some people.

I think I did a YouTube video before on how to get started with like 200 or something crazy low like that. It’s definitely possible. You can get really big lists of marketing, but it’s going to take some time. Like I said, then you have people on the other end The spectrum who have 50, 000, they’re ready to throw money into market.

They’re ready to do all these different things and really grow fast. Both ends do their, their situations from both ends that do really, really well. Sometimes people with 50, 000, it’s just too easy. They think it’s too easy or something like that. They don’t learn and they try to outsource everything. So they.

Don’t actually learn what’s happening. They don’t understand the business versus the person with 500 that they got to do everything themselves. So they’re learning so much as they’re going. So there’s advantages for sure to both ends. Other than that, guys, if you have any questions, if you’re watching on YouTube, leave me a comment below.

If you have any other topics you want us to talk about, let us know, hit the subscribe button, hit the like button. We’ll see you next time. Thanks. As always, thank you for joining. Please do us a huge favor and like, and subscribe our YouTube channel. And share this with a friend. It really means the world to Ron and I, but more importantly, it could help change the life of someone else.

Thanks for joining. And we’ll see you next episode.

Watch the Full Episode Here

https://www.youtube.com/watch?v=ZMiF1XZmBzg