2025’s Hottest Land Investing Niches (And How to Cash In)

Featured

How to Score Bigger Land Deals with Direct Mail in 2023

Scale Your Land Flipping Business to Millions in 36 Months (BLUEPRINT)

The Raw Land Deal That Made Us $200k and Cost Us Nothing

Land Flipping 101 (BEGINNERS GUIDE)

How to Choose a Profitable Land Market to Invest In (2024)

2025’s Hottest Land Investing Niches (And How to Cash In)

Join our free Discord channel!

Engage & network with thousands of new and experienced investors, participate in weekly deal reviews, and more!JOIN

As we look toward 2025, land investing continues to be an exciting and profitable space. With the landscape of land investment evolving, understanding the top niches can help investors maximize their returns and avoid unnecessary risks.

In this article, we’ll break down the most lucrative and efficient land investing niches that will dominate the market in the coming year.

1. Minor Subdivides: A Goldmine of Opportunity

Minor subdivides are arguably one of the " target="_blank" rel="noopener">most profitable land investment strategies in 2025. The concept is simple: buy a large parcel of land at a low cost and subdivide it into smaller, more marketable lots.

The beauty of minor subdivides lies in the ability to turn a single large purchase into multiple, higher-value parcels, often at a significant profit margin.

For example, a property that costs $2,000 per acre may be subdivided into several smaller parcels, each selling for $6,000-$7,000 per acre. This dramatic increase in value is what makes minor subdivides a highly attractive niche.

The key to success here is securing land with substantial road frontage, which helps increase the parcel’s marketability and sale price.

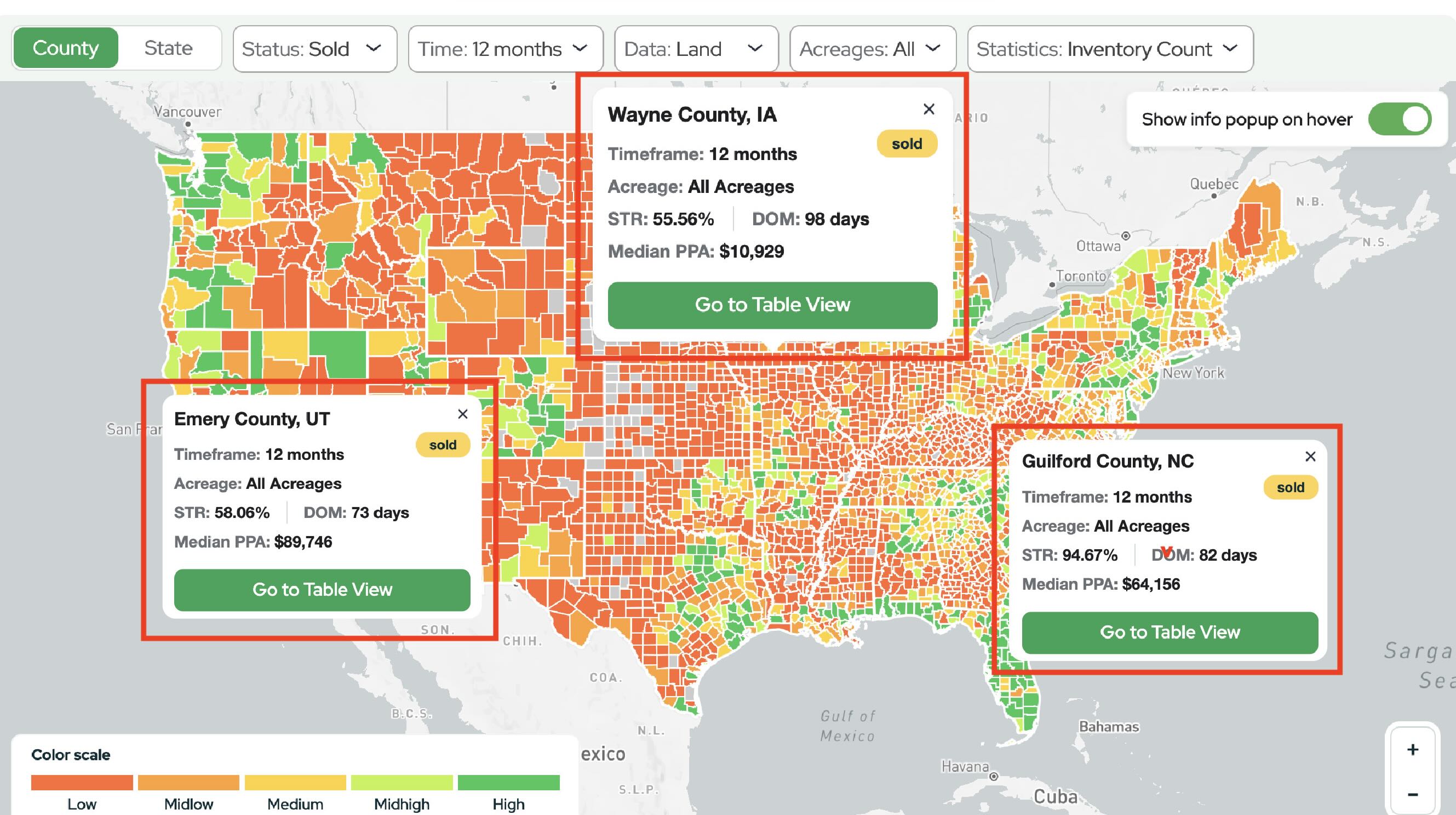

By using tools like The Land Portal, you can quickly identify properties with ample road frontage and other desirable features that make them prime candidates for minor subdivides.

The scalability of this strategy, combined with the ability to offer land at market value and still see significant profits, makes minor subdivides the top niche for 2025.

2. High-Ticket Double Closings: Less Risk, Bigger Profits

High-ticket double closing is another standout strategy for 2025.

This method involves finding undervalued land, negotiating a purchase price with the seller, and then reselling the property at a higher price, often to another investor, before officially closing the deal.

The key to success with this strategy lies in buying land at a steep discount, making it possible to double-close and still see a significant profit.

What makes this niche particularly attractive is its lower risk compared to other methods. Since you don’t have to put money down for the full purchase price and instead operate on the spread, your capital is preserved.

Additionally, because of the high demand for quality land deals, double closing offers a competitive edge by targeting deals that other investors might overlook.

The simplicity and low-risk nature of high-ticket double closings make it a great option for both new and seasoned investors.

With no need for heavy upfront capital, this strategy allows investors to scale quickly, all while generating impressive returns.

3. Survey Hacking: A Niche with Great Potential

Survey hacking is a strategy that is gaining more traction in 2025, particularly in rural areas where larger parcels of land can be subdivided into smaller, profitable lots.

The concept involves purchasing land and working with a surveyor to break it down into multiple parcels, which can then be sold for a higher total value.

While survey hacking isn’t as widely known as other land investing methods, it presents substantial potential for those willing to do the research.

The challenge lies in finding properties that are suitable for subdivision, ensuring the correct legal entitlements are in place, and managing the survey process. However, once you have the right knowledge and network, the rewards can be significant.

The flexibility of survey hacking, where you can potentially subdivide parcels in various ways, makes it an appealing option. By collaborating with surveyors and understanding zoning regulations, investors can maximize their returns.

Survey hacking might not be as easy to scale as other strategies, but it offers good opportunities for those willing to put in the work.

4. Smaller Lot Deals: High Volume, Lower Risk

Investing in smaller land lots, particularly in rural areas, is one of the most accessible strategies for newcomers to land investing.

What sets smaller lot deals apart is the volume.

By purchasing several lots at once and selling them at a higher price, investors can achieve substantial profits with relatively little risk.

The lower capital requirement also means you don’t need to take on significant debt or face the same level of competition as larger lot deals.

This method typically involves purchasing lots of around 1-5 acres and flipping them for a modest profit. The barrier to entry is lower compared to higher-ticket deals, making this an ideal niche for beginners.

While the margins may be smaller, the ability to do numerous deals in a short time makes this niche attractive.

For those looking for a steady income stream from land investing, smaller lots are a great place to start and can be quite profitable if executed well.

5. Tax Sale Properties: High Risk, High Reward

Tax sale properties are often seen as a niche for more experienced investors due to their higher risk and complexity. These properties are typically sold at public auctions when property owners fail to pay their taxes.

While tax sales can offer significant discounts, they come with several challenges.

The primary issues with tax sale properties are the complexities around title issues, ensuring the property is free from liens or other encumbrances, and the need for extensive research.

There is also the risk that the property may be encumbered with a landfill or other environmental concerns, which could lead to unforeseen expenses.

However, for those who have the right knowledge and tools to navigate these hurdles, tax sale properties can still present lucrative opportunities.

If you're considering this route, make sure you understand the risks and invest time in thorough due diligence to avoid any pitfalls.

6. Entitlement Deals: High Barrier to Entry

Entitlement deals, which involve gaining approval to develop a property for a specific purpose (such as building homes, commercial properties, or even subdividing land), are among the most profitable land investment strategies.

However, they come with a high barrier to entry due to the complexity and time involved in securing entitlements.

This process often takes years to complete and requires significant upfront capital. Additionally, dealing with various legal and zoning requirements adds layers of complexity.

Despite the barriers, entitlement deals have some of the highest profit margins because they unlock the potential for high-value development projects.

Because of the high risk and long timelines involved, entitlement deals are best suited for investors who are already experienced or have access to resources to navigate the complex regulatory landscape.

Final Thoughts

As we enter 2025, the land investment space remains full of potential.

Whether you're looking to make your first deal or expand your existing portfolio, the key is to focus on niches that align with your risk tolerance, investment goals, and expertise.

Minor subdivides and high-ticket double closings are great for maximizing profits with scalability, while smaller lot deals offer a lower-risk entry point for beginners.

Survey hacking and entitlement deals may require more effort and expertise, but they can lead to substantial returns if executed properly.

By diversifying your approach and staying informed about the top niches, you can position yourself for success in the ever-evolving land investing landscape.

We did a whole video discussing the top niches in land investing for 2025!

➡️ Watch it here.

Listen to the Latest Podcast

View Transcript here

Ron A.: Welcome back to the real estate investing podcast. I’m your host Ron Apke joined today by Eric Scharaga. Eric’s a huge funder in the industry for land deals. He does a ton of land notes, been doing land notes since 2017. Eric, welcome to the show. Rod. Great to be with you. Thank you very much. And this is part two.

I mean, we’ll, we’ll touch on a lot of the. Stuff that we talked about a few years ago, lots changed. I’m sure that we can talk about. But if you guys haven’t watched the first one, probably watch this first thing, go back to the first one. But Eric is a wealth of knowledge in the financing space, everything like that.

A lot of people, Eric, are talking about like seller finance. I think that’s a big thing because you get so many people and you hear passive income, passive income, passive income. So, so many people like come into real estate and that’s what they view real estate as if it’s rental properties or land notes or anything like that as passive, they talk about seller financing is, is, is that note?

Space growing in land investing, or first you want to kind of define what seller financing is in your mind. What that kind of looks like, and then we can talk about kind of what the industry looks like right now.

Eric S.: Great. So seller financing in my mind, as it pertains to land is offering another option to your buyers.

Besides just a cash sale, it provides flexibility. And it provides an opening to an entire new buyer pool. So if you want to sell land faster and for more money, you really should be considering seller financing. Because in this current market. You really will sell your land probably three to five times faster if you’re considering that financing it and you’re essentially just acting as the bank.

So you own this property and you’re providing the terms to the buyer. So you are taking some cash at closing, typically 20 percent or more, and you’re providing terms and you’re providing the loan to the end buyer, which is a really a win for all parties. And then a lot of people either at closing or after closing explore the sale of the loan, because depending on what business that you’re in, it might make more sense or less sense to Keep the note or sell the note because you know, land investors, their, their primary businesses flipping land and that’s where they make the majority of their money.

Whereas my business is different. I don’t run a land business. I run essentially kind of a debt business. So my goal is to obtain those loans and I, I make my income from. The principal and interest payments.

Ron A.: Yeah. So I guess you have two kinds of sets of people. You have people that are trying to like flip land, make cash.

And then you also have people who might be coming in this business. Like I want to build up a note business and have 15, 000 every month coming in. I guess those are, those are kind of clear avenues. And so one party is trying to essentially, let’s talk about the people that are selling notes. That’s people who more so relate to us or kind of people that are following us are people who want cash.

Like they want cash so they can put it into marketing, put it into the next deal, grow their business, opposed to like having all their money out and then slowly getting money coming in. So if someone has never offered seller financing, so essentially you want to sell for, you want cash, but okay, here’s another avenue essentially where you can still end up getting cash.

So what, what does that look like? What’s different from their end that they’re doing if they want to potentially get seller financing buyers, but still sell the note?

Eric S.: Yeah. So what I would recommend is probably working with someone directly who can help you both market the property. And then help you through the closing in terms of providing the necessary paperwork so that you are selling the loan at closing and you can capitalize at closing.

What I recommend is the note buyer is going to want to purchase the loan at discount. The way to get around that is to have a different price for your cash sales as your financed sales, because people typically, in my experience, are willing to pay about 10 percent more for the luxury of seller financing.

The other things that I would recommend, you know, there’s, there’s really, what you need to keep in mind is. Big down payments. That’s really your security. Some form of credit check, high interest rate, but not too high. I think 11 percent is good and as short a term as possible because we are not Fannie Mae and we’re not in the business of providing 30 year financing for people because the longer the term, the higher the risk of default.

Ron A.: So let’s, let’s break down a deal. For example, let’s say someone has a Right now, someone listening has a hundred thousand dollar piece of land that they have posted. It’s sat on the mark market for three weeks. They still think they should be able to get a hundred thousand dollars. What should their, let’s kind of break down what that looks like when they offer seller financing.

What, what should they be doing? They have all these listings out posted for a hundred thousand dollars, MLS land. com, all these different places. What should they be? What should their next steps be to offer seller financing?

Eric S.: Yeah. So what I recommend is that you put in your listings that seller financing is available, but do not put any of the terms in the listing because not everyone will qualify for the terms that you advertise and you don’t want to post any type of discriminatory ad.

So just keep it very general that you’re offering seller financing. and people will call in. When they call in, I recommend that you ask them two questions. The first one is, do you have 20 percent down? If they don’t, in my opinion, they can’t afford it and they probably shouldn’t be buying it. If they do, great.

Your second question is, how’s your credit? Depending on the answer that you get, you will know essentially by reading. between the lines, how their credit is. Some people will say, well, that’s none of your business. Some people will say, I have no idea. Some people will say, oh, it’s good. This is my credit score.

And really the way that I recommend that you, when you get to that point, credit karma is a great way to very easily gauge someone’s likely credit score. It’s just fast and easy and they that’s something that they can screen shoot and share with you. In lieu of doing like, a formal credit check, it’s not perfect, but it’ll give you a good indication.

Ron A.: So, they will be trying to sell for like, 110, 000 dollars. Theoretically with this let’s say they find someone what credit score are they looking for? 1st off.

Eric S.: My cutoff for 20 percent down to 690 just because these are typically non owned or occupied sales. And so we want to make sure that this is someone, an end buyer, who can both afford it.

and has a proven track record of paying their bills on time. But in my experience, the two, probably even more important than the credit score is the down payment. People don’t walk away, in my experience, from large down payments.

Ron A.: That makes sense. So listed for one 10. Okay. We got someone with the credit.

That makes sense. Okay. Someone’s credit 700 credit. Awesome. 22, 000 down they have. Okay. So someone comes to you in that situation, they get this person, are they getting this person under contract with these? Are they like, okay I know I don’t want to hold this loan. So your options. I guess we would be talking about interest.

Let’s get interest first. What, what interests are we talking about them or should they not be talking about interest with them yet?

Eric S.: I recommend that once they answer the two questions and you move on to negotiations about the property, you’re going to need to settle the purchase price, 10 percent over your cash price amount down 20%.

Or more if they offer more term, I think eight years, 10 years, that’s really the sweet spot. And then interest rate, my standard is 10. 9, so right around 11%, some people do 12%.

Ron A.: Alright, so then they’re coming to you, do they get this under contract if they, if they have the idea of selling a note on the back end, should they be getting this under contract, all these terms that we just talked about under contract, and then kind of reaching out to someone, be like, I have this buyer, is that correct?

Eric S.: Yeah, that’s exactly the way it works. So typically under my note buying program, they would do the initial negotiations and then I would do the credit check and then I would get back to them with what I call a term sheet. It has all of the terms of the of both the seller finance. Sale and the amount that I’m going to end up paying for the loan and then they will just attach the first portion of their contract.

They’ll submit it to title and then I will be there to help them through the process of getting the deal closed. I kind of know how to deal with the title company. So I’m there to advise them on that.

Ron A.: So in this situation, 110, 000 is what we agreed to on the term 22, 000 down. So the loan is 88, 000. What is this land investor going to see once you buy the note?

Eric S.: Yeah, 80 to 90 percent of the sale price.

Ron A.: Okay. Of the sale price.

Eric S.: 110, 000, if they’re selling at 110, 000, they are going to net the same amount as if they sold for cash at a 10 percent discount.

Ron A.: So

Eric S.: whether you sell at 110, 000 and receive 90 percent at closing of your sales price, that’s going to be the same as if you sell for 100, 000 cash and someone comes in with a 90, 000 cash offer.

And you take it, the only difference is that you’re going to be selling the property, probably three to five times faster. If you offer the financing,

Ron A.: yeah. Are people doing this in faster markets? Or is it like, I think having more options when you’re in a slower turning market typically is always valuable and you have people, I mean, you just got to obviously make sure you have a qualified person to hold the, or to to be able to sell the note.

But what, what markets are people? Are you just having people like offer this all the time? Cause I mean. A lot of people don’t want to lose 10, 000 just to lose, but if you could sell it, that’s if you could sell it for 100, 000 cash or 100, 000 on a bank loan. But realistically, if you’re struggling to sell something like this needs to be an option.

Are you seeing this in fast markets, slow markets, it doesn’t matter?

Eric S.: Really all markets, most of the people that I work with are offering this financing on every deal. Where I really think it works well is more expensive properties, 150, 000, 100, 000. Because those people don’t necessarily have the cash, but they do have the 20 percent down and they’re willing to make the payments.

So that’s really where it works well, but it’s really universal. You know, and I would argue that. Whether you sell the note at closing with financing or whether you sell for cash at a discount, you’re really going to end up with the same net amount at the end.

Ron A.: Yeah, that’s a good point. And is there push, I mean, I’m sure there’s some pushback at times, like raising the price to 110, 000 for these, but I assume it’s pretty understandable.

How often are they getting pushed back? How, like, is that pretty like standard in terms of being able to sell over asking price when it’s a seller financing?

Eric S.: Yes. So in my opinion and experience, Seller finance seller financing is so rare and such a luxury that p people are willing to pay 10% more for the ability to make the payments over time.

Ron A.: And that’s not like a standard thing. Guys. Also, like you wanna try to go for 15%, like if you think it’s, you can get 15% and make it $115,000 loan, I’m sure Eric would still be interested. What does your like looking at the deal, like how much does the land matter when you’re buying these notes? Or if you have a buyer, like it doesn’t matter what, or is it like you have a qualified buyer?

It makes sense. Or is it something like, okay, are you thinking about if they defaulted what you would do with the land?

Eric S.: Exactly. So that’s an extremely important consideration. I do look at the land very carefully. If it’s a smaller lot and there’s no PERC test, that’s going to be an issue for me because I don’t want any huge surprises after I purchase the loan.

So that is an issue on some deals. So I, I am not willing to purchase notes on any piece of land. I do look at the land very carefully and it has to be something that I’m going to be comfortable with if I do get a default going back out to market and being able to sell in a reasonably short amount of time.

Ron A.: That makes a lot of sense, and yeah, just not getting anything for sure.

Ever wondered how land investing can be the fastest path to financial freedom? I break it all down in my new book, One Lot at a Time. I’ll show you exactly how to find, buy, and flip land for huge profits without dealing with houses, tenants, or any crazy renovations.

It’s simple. This is the book that I wish I had when I first started. If you’re ready to take control of your financial future, Grab a copy now, one lot at a time by Daniel Apke, find it at your local bookstore or on amazon. com.

Ron A.: What does your business look like in terms of your note business right now?

How many notes are you holding? I think a lot of people are going to be like, okay, this is a interesting side of the business in terms of the note business, like you’re holding, you’re buying a ton of notes you’re providing, and there’s so much value. Like this is your business is having all these notes.

People who follow us, a lot of people that follow us, like I want cash. And they, they want to sell notes to people like you. But what is your note? Business look like, how many notes can you hold? Like, are you trying, what does that look like though? Right now?

Eric S.: It’s, it’s large. There are a lot of notes.

I couldn’t even tell you how many there are. I mean, I don’t manage them on a day to day basis that’s done by a loan servicer. I just kind of look at the spreadsheets. It’s a, it’s a lot, but you know, there’s, there’s always room for growth there. It’s my goal to keep buying more.

Ron A.: For sure. What’s your background prior to 2017 in terms of like, what were you doing to, you obviously understand the financing stuff.

I assume you have a background in something like this before that.

Eric S.: Yeah. So I was a high school English teacher for 23 years and I did fix and flip and buy and hold for 13 years. Starting in 2002, I burned out on that. I discovered note investing and I just loved that business. I mean, it was just so hard.

I think I quit like three or four times. But once you learn it and learn the steps and learn the procedures, I really learned the business by buying non performing junior lien residential mortgage loans. Which was just kind of like a crazy niche. And I did that for many years. We would buy them in pools and that’s how I kind of learned the business was through the default side, because you just learn so much about the individual state laws.

And then I discovered, you know, I, that, that business kind of ended up ending because all the defaulted loans were sold off. And then I discovered land through a friend and I just thought, wow, this is just an amazing opportunity for seller finance.

Ron A.: So were you, as you were a high school teacher, were you doing land or were you doing these other things on the side, the fix and flip stuff?

Eric S.: Yeah, I was doing both. So I was doing fix and flip, buy and hold. I had like 30 rentals at one point. I ended up selling them all off, but that’s a tough business. I would not want to have to do that again.

Ron A.: How’d you manage that I got

Eric S.: married and I had kids and you know, you can’t really be like, Working on flip projects on the weekends and like managing contractors all the time when you have like a wife and kids, it just got, it became too overwhelming.

Ron A.: One thing I like about like your business, like very little of what I wrote down before in terms of like, you’re no business. It’s just grown. Like, you know, you know, your lane in terms of like what you do and like, you don’t really go outside of that. You just. Grow within that which has been, I think you, you’ve exploded in the last couple of years in terms of the amount of notes your funding as well.

But let’s transition here, Eric, to funding, cause you do deal funding a little different structured than a lot of people, which is good. It’s always good to have different options, everything like that. But first let’s just get into what have you seen over the last few years in terms of the funding space?

And guys, we’re transitioning away from seller financing right now. We’re talking about you come to a funder, you come to a group of funders, whatever it is, and you’re trying to get your deal funded. But what have you seen in the last couple of years in terms of deal funding?

Eric S.: So I, I don’t really do a lot of traditional JV funding.

The majority of what I do is lending, commercial lending. So I provide loans, acquisition loans for land investors to purchase properties. It’s a lot lower cost of capital. Then the JV funding split I’m seeing a lot of subdividing going on, which really works well for the debt space. The other thing that I’m seeing that’s interesting is that the really the 50 percent of value acquisition in hot markets that are selling very quickly.

Those are becoming more and more of a unicorn. And in those situations, I’m seeing people buying at 65 cents on the dollar, 70 cents, maybe even 75 cents on the dollar. If they know the market, they know it’s going to sell quickly, and they’re still really making a lot of money doing that. So that’s kind of an interesting dynamic that I’m seeing in the space.

But I speak to a lot of land investors on pretty much a daily basis. Yeah. So I see a lot of, a lot of dynamics and then I have my internal data that I have on all of the loans that I’ve done.

Ron A.: So JV and guys to define that it’s going to be like, okay, you come to a deal funder and you guys are splitting profit on a deal or something like that.

Eric’s talking where you have interest payments Stuff that is a little probably it’s riskier for definitely the investors. So I assume you work more so with more experienced investors, not only for your good, because you have a better chance of getting paid out everything like that at the end of the day, but also for their good, where like, maybe it’s the best thing for them to work with the JV partner their first three, five deals before they try to maybe lock down and get a little bit cheaper money that is a little more risky.

If you just look at it by the books.

Eric S.: Yeah, so in my experience, when people first start out, they really need the funder because the funder is not only going to fund 100 percent of the deal, but they’re also going to give them guidance on best practices and getting the property sold quickly. Typically, what happens is, as their businesses grow, they look for a much cheaper cost of capital and source of capital in terms of, like, being able to call somebody up or send him an email and have Have a commitment for a loan within 24 hours.

So that’s really the type of investor that I work with. Somebody who’s looking for a fast, easy. Capital and the property in their name and having full control and a lower cost of capital than the JV split.

Ron A.: And there’s not many people. Like you in land, like all the people like you are in fix and flips or a house flipping and they’re giving.

But as far as like people who understand the land business giving debt opposed to giving the JVM, like there’s not many people. Like, I don’t know if there are any other people that are doing just like you, that it’s like, this is your business model in terms of the funding aspect. Have you seen anything else like it or in terms of I, I guess what, what made you kind of stay in land and do this for land instead of other things?

It’s just your expertise that you’ve grown.

Eric S.: It took me a long, long time to learn land. I still am not an expert. I have two analysts who I work with on all of the deals that I finance and they’re much more experienced and savvy than I am. The difficult part about lending is that you have to know all of the.

Compliance laws on the federal and state level because there’s federal laws that you have to follow, but then there’s individual state laws. They’re all completely different. And the compliance for these loans can be kind of overwhelming at times. It’s a very different business. Then JV funding, which really isn’t regulated anyway, you sign the contract, you’re working together and you can get started.

Whereas as soon as you kind of use that term interest, you are governed by a lot endless laws and regulations that you need to be aware of because if you’re not following those, you can get in big trouble because state regulators are watching what’s going on and they kind of assume that That lenders have deep pockets and they just love to find them if they are working unlicensed or not following the guidelines and regulations and compliance.

Ron A.: So they come for the lenders and not come for like our land investors getting hunted down as well. If they are, if the lenders not complying with the whatever state federal codes.

Eric S.: No, no, it’s 100 percent on the lender. If you’re originating loans to a borrower you are 100 percent responsible. They don’t really look at the borrower in those situations.

They expect the lender to know all the rules and laws.

Ron A.: That’s interesting. What are the, what kind of compliance is it, is like making sure they’re not taking advantage of people? What, what does that kind of look like in terms of the compliance? I’m sure there’s a lot in different states. I’m sure some states have it absolutely crazy in terms of the compliance documents.

Some are probably a lot shorter. What does that look like from state to state or some of the most outrageous ones you’ve heard?

Eric S.: So it’s different in every state. The first layer is licensure. There’s many states in which you have to have a license to do any type of lending. Even commercial lending. Every state, you have to be licensed if you are doing, um, consumer lending, commercial lending is different.

I’m not an attorney and I don’t want to be passing on like, legal advice here for that. You would need to consult a you know, a banking attorney and those guys charge like a thousand dollars an hour. But you know, really all I can say is that, There’s issues of usury. There’s issues of Maximums that you can charge.

There’s issues of Federal compliance regarding closings and what needs to be provided at closings. So it is You know, relatively complicated field.

Ron A.: That makes sense. You said a little bit ago, like you’re not seeing, you’re seeing purchase prices go up relative. Is this an, again I think we talked about before we hit the record button.

You’re seeing that a lot, especially in faster markets, like purchase prices, buying a 50 percent of market value is getting tougher.

Eric S.: Yeah. I actually get a lot of deals in my finance business that are rejected from funders because they’re, they weren’t purchased cheaply enough. Like they’re. Being purchased 70 cents on the dollar.

There’s still a great margin there. If it’s going to sell quickly. It’s not a good fit for a funder, but it’s a great fit for me because I’m not really looking at the profit because I’m not linked to the profit. I’m just looking at the loan to value ratios.

Ron A.: So is that so they should be, if they’re trying to do that, as far as buying, and we, we suggest the same thing.

If you’re in a faster market, like you can definitely push it because. Your ROI, like irregardless of a fund or a bank, whatever that’s happening, irregardless, like if you are moving a deal buying for 70 cents on the dollar and moving it in a week versus buying for 50 cents on the dollar and moving in a year, like your return on that said, that first option is much, much better because how fast you’re turning your money.

And I guess that’s when it makes sense for you. Does that tighten up like your analysis of a deal though? When like, okay, we’re getting a little closer to I don’t want to put. You don’t want to put an investor in over their head at the same time, even though you’re collecting interest, stuff like that.

But I’m sure that makes it a little more tighter in terms of you reviewing the deal. Is that accurate?

Eric S.: Yeah, absolutely. I, my main metric is loan to value. So what am I lending versus what is the property worth? Another interesting thing that I’ve noticed is that as I’ve been doing this, the realtor opinions on the properties.

Are by far and away, the most rosiest, you know, I used to require a realtor opinion and then I dropped that just because, you know, there were so many cases in which the realtor opinion was so far off what the data was showing. So I look at that, but I don’t. Really look at it as carefully as I used to I rely more on my Internal analysts.

Ron A.: Yeah, that’s a really good point And what I do with Realtors and what we always suggest with Realtors is like first You got to come up with your own opinion like come up with a pin your opinion Maybe you get a second set of eyes from the community something like that And then after you already have like I feel good about this property Feels very much comps are showing that then you have a realtor come back or two realtors come back, say 80, 85, 000 for the sale price.

You need to push back on them. I think that’s the biggest thing that I tell our students to do is when they get realtor opinions that they don’t think is accurate, are accurate. They’re experts too. Like don’t, yeah, the realtors know the area, everything like that, but pushing back on them, like, okay.

You’re saying 85, 000. Here’s a comp that’s very similar down the road that just sold for 55. How are, I literally will ask them, like, how are we going to get 30, 000 more than this property? Like what was wrong with this property? And a lot of times they kind of fumble with their words with that stuff for sure.

Eric S.: Yeah. It’s been interesting. That’s really one of the reasons that I think that this space is a more popular. It’s just because there’s just not as much valuation data out there. And the valuation is definitely an art. And I still struggle with it. I mean, there’s like 3 of us putting our. Brains together.

We might be way off on our, what our opinions are. So

Ron A.: it takes time. It takes time. And like, still, like when you go into one of those markets without a lot of data, you’re like, I don’t know what the heck’s going on here. Like I have a conference 2022, like that looks okay. But I would assume the market did something says 2022 and like, that’s legitimately in land and it’s also three miles or seven miles away.

So like sometimes your best comp is a really bad comp. If you’re comparing to house comps, everything like you can get a neighborhood comp 99 percent of the time in suburban America versus these, like it is a, it’s an art and that’s a good point. And you said you have three people, you and two analysts, is that their full time job, just like analyzing deals that are coming through.

Eric S.: No, so they are just paid on a per deal basis. They are both highly experienced land investors. It’s really not something that you can bring in a VA for and train them. I just wouldn’t feel comfortable with those opinions. So these are seasoned veterans who do this for me on the side.

Ron A.: Got it.

That makes sense. So. Let’s wrap it up with like, what do you think the future of this business is in terms of land? Just curious your insights. You, you obviously are doing a lot of deals. What do you think the future of the business is though?

Eric S.: I think it’s an amazing business. It is still an amazing business.

One thing that I am seeing is that some people are leaving. Because the industry is changing, it’s becoming a little more challenging, but I still think that there is just endless potential in so many markets in so many ways. I think it will continue to be a great business moving forward. I just don’t see like private equity or wall street moving into this space just because there are so many significant barriers to doing this on a large scale.

So I, I, I just think it’s a great, I mean, I’ve done a lot of things in real estate and this is probably among the top two best that I’ve done.

Ron A.: Yeah, it’s cool. The people that can be successful and the people that are falling off and we see it, I mean, right. I think regularly you see people fall off.

It’s the people that are trying to do the business the same way they’ve done the business since 2020 or something. They were making, maybe working this as a side job, making 100, 000, 200, 000 a year. And just kind of, and then they just, their reasoning is like the business died off. Like, no, you, your, your strategies didn’t evolve.

Like, and I think that’s the biggest thing in any industry is evolving your strategies. I’m sure. Like I said, your, your funding hasn’t changed that much over the last couple of years and you have your plan, everything like that. But as far as with land investors, and I’m sure like the most successful people you work with, like they are doing some pretty diverse things and kind of adjusting their business.

I’m sure, I don’t know how much you know about their individual businesses, but being able to adjust is really, really important.

Eric S.: So probably. You don’t know this, but probably the number one best investor that I work with. The guy that I have the most respect for. This guy is just unbelievable. Came up through your program.

Ron A.: It’s good to

Eric S.: hear. I’ll tell you his name later. No, that’s good to hear. I’m glad. It’s just an absolute monster in the industry. But there are so many people who are flying under the radar and just absolutely crushing it in this business who you don’t even know are out there because they’re not posting on social media.

They’re not training. They don’t have a program. They are doing the business day in and day out. And just the, the deals that I see them do. They’re really remarkable. It’s an interesting perspective for me because I’ve never run a land business. I never will run a land business, but I see people really doing amazing things.

Ron A.: You’re running a land business, just a different type of, yeah. Yeah, that’s a good point. Cause I mean, I have been reached out to so many of our students and just like ask, Make sure they’re doing something, but the amount of people that are just doing this business at a high, high level, and I haven’t heard a damn thing from them on Discord or anything, and like I would guess like, okay, they’re just sitting on their hands, not doing anything.

Then they come on the podcast. I had one person come on the podcast, he’s like, yeah, I did 30 deals in the last year and my first year. He’s like, is that, is that a good thing? I’m like. Yeah, that’s a, that’s pretty good for your first year, year, flipping 30 land deals. And he made a few hundred thousand dollars, 400, 000 or something like you’re killing so many people that are under the radar in terms of doing that.

Anything else you wanted to add, Eric, that we missed before we get off here?

Eric S.: You know, I would say, I would encourage you to reach out to me. Um, regardless of the the business that you’re running, the size of the business that you’re running, I’m really confident that I have a program that can help you improve your business.

So feel free to email me or call me. And I really do feel like I can provide a unique program that really can help you expand your business and make it more profitable.

Ron A.: Are you in a, you in our discord server, Eric? I am. Yeah. Okay. And our discord server, everything like that. Awesome. And like at minimum guys, if you’re, if you have a land sitting on the market offer that those first 10 minutes of this episode were absolute gold in terms of like how to offer that.

Seller financing and you can cash out on it. It is not holding a note. We’re not asking you to hold a note for 10 years. Eric will buy your note. If it’s good land, if you have a qualified buyer. So I think at minimum guys, if you’re doing this business, flipping deals, you have deals sitting on the market at minimum, you guys should be offering that.

Maybe you don’t want to do it the first two weeks or three weeks you have it on the market. And you’re like, crap, I can’t sell this. Then have that as an option. I would do it out of the gate, to be honest, and just up that 10, 15 percent over asking price and go from there. But Eric, I really appreciate you coming on guys.

If you are watching on YouTube, hit the subscribe button below. If you’re listening on Apple or Spotify, share this with a friend. Thank you so much. We’ll see you next time. Thanks Ryan.

Watch the Full Episode Here

https://www.youtube.com/watch?v=ZYMDUz3H-6I&t=1s