He’s Set to Profit $260,000 After Subdividing 144 Acres of Raw Land! (HERE'S HOW)

Featured

Your First 6 Months As A Land Investor: What to Expect

Making $300K From a Single Flip with Guest Shelby

How to Make 6 Figures Flipping Land in ONE County (GUARANTEED)

How to Mail Merge for FREE Using Google Docs

How I Quit My Job & Made 8 Figures as a Land Flipper: Ron Apke’s Story

He’s Set to Profit $260k After Subdividing 144 Acres of Raw Land! (HERE'S HOW)

" target="_blank" rel="noopener">

Join our free Discord channel!

Engage & network with thousands of new and experienced investors, participate in weekly deal reviews, and more!

JOIN

In this episode of The Real Estate Investing Podcast, Ron Apke is joined once again in the studio by his brother and fellow land investor Mike Apke.

Mike shares his journey from a traditional 9-5 job to achieving financial independence through land investing. He begins by recounting his early days, discussing the steady profits he initially made and how this side hustle quickly gained momentum.

As he grew more experienced, Mike found himself drawn to larger, more complex deals, allowing him to scale back his hours while still seeing substantial returns. Now, by tackling big subdivide projects, he’s been able to free up time to focus on his other business venture, Droners.io, a company that brings drone pilots and clients together for various aerial services.

One of Mike’s latest projects is a 144-acre subdivide deal that he’s splitting into 13 parcels, with an impressive goal of generating $260,000 from the sale. He discusses the strategy and mindset behind managing such a large-scale project, offering valuable insights for those interested in expanding their own land investing portfolios.

His story is an inspiration for those looking to diversify their income streams and make the most of both their investments and their time. Whether you're considering land investing as a side hustle or a stepping stone to greater financial freedom, Mike’s journey is a motivating testament to the opportunities this niche can provide.

⬇️ Watch or listen to the full episode below!

Listen to the Latest Podcast

View Transcript here

Ron: Hey everybody. Welcome back to the Real Estate Investing Podcast. I’m your host, Ron Apke. Joined by my brother, uh, LandInvestor, Droners.io, uh, not founder, owner, uh, Mike Apke. Mike, happy to have you here talking about land today. Yeah. Thanks for having me again. Yeah. So how long have you been doing land?Mike: I want to say I started in March.

2022.

Ron: And you’ve had, you’ve had an interesting journey for sure. Like there’s been ups and downs, as you know, like land is a, it, there’s times when mail is not working well. Let’s, let’s actually get started on there. Michael, you started in March, 2022. You did things very similar to how we do things as far as like how we’re acquiring direct mail, everything like that.

Um, how was like that first year? I guess let’s talk about 2023 a little bit. If you remember 2022, 2022. Yeah.

Mike: Yeah. The first year, um, it was, it was tough at first. Well, the first county I sent out, I got like, it was, yeah, it was Indiana County, Pennsylvania. Yeah. I sent out like 3000 mailers went all the way down to one acre.

Didn’t know what I was doing. I’m sorry. That was the second county I sent out. And I got like 65 calls back like crazy. And I just got three deals in that county, small deals. Um, but that kind of set me up to get rolling. Uh, and then, then from there it was. Yeah, it was tough the first year. I think, I think a lot of it is that the learning curve.

So I didn’t really know what I was doing. It took a lot more time to analyze the land. Pricing took a lot more time. I didn’t understand things as well. Um, but by the end of 2022, I hadn’t made a lot of money, but I had equity in properties, I’d bought a decent amount. I don’t remember exactly how much it’s been too long, but I remember I hadn’t made a lot of money.

But I had a lot of equity, so I was like feeling good and good to keep pushing forward.

Ron: So talk about going into 2023 and what that kind of year I’m going to skip through a lot of the we’re not going to spend a lot of time on the old, but I just want to give everyone a background on where you come from as far as that.

Mike: And I’ll say to in 2022, I got it. I probably was I was probably down like 15 20, 000 at one point. With equity and properties though, so I was negative 15, 20, 000, just cause I kept pushing out mail, but I had equity and properties. I know it was going to turn around, uh, 2023. Was a, um, good, uh, that was, that was profitable year, very profitable.

I started getting some big properties. Um, I remember one, I think you guys funded, I believe you funded this. It was 65 acres in Pennsylvania. Uh, what was it? Buy for 65, sell for 165. I think, and we bought that actually at the, we bought that maybe at the end of 2022. Yeah. And sold it April, 2023. So that got 2023.

Uh, moving well, starting well. Um, and then I had another big property. It was a buy 1 35, sell two 70, uh, 65 acres in North Carolina, couple other big ones, and a bunch of mid-size deals. So it’s 2023 things we’re rolling.

Ron: it’s 2023 things we’re rolling. Yeah. You sprinkle in those small, you sprinkle in those big deals with the sm with the small to medium deals.

And that’s what like really. It’s a, when you start getting those 60, 70, 000 checks that you’re making on a single deal, like it’s a big difference. And then like those 15, 000 ones don’t seem like they’re just like dragging you along. Cause that’s sometimes what it feels like. Like you’re making money on the smaller ones for sure.

Um, it’s making more money than you’re marketing everything like that, but it’s kind of like, okay, I need something to like really hit. And I think that’s what you saw into 2022, which is nine months in eight months in when you got that first big deal. Yeah. Okay. So 2024, uh, big year, as far as a lot of stuff happening, uh, I know you’ve had some breaks in mail, stuff like that.

We bought droners. io, which we won’t get into as far as details and that you quit your job. Um, but let’s talk about 2024. Um, just kind of where, I don’t even remember, honestly, where were you at the beginning of the year with the land? Just kind of transitioning over from 2023, same stuff, sending mail. You haven’t done any texting, correct?

Mike: No, I have not. Uh, yeah, I have not done any texting. Um, sold, sold a couple good size deals in, in 20, 24 that I had bought in 2023. Um, so 20, 24 started out well, and then once I bought droners, I put, put, put land. Um, I, I still did my disposition work, but on, in terms of acquisition, basically cut it because I was running droners, getting that up and running.

And I still had a nine to five. And then since I’ve quit my nine to five, I believe at the end of July, quit my nine to five, July, 2024, quit my nine to five. And I’m, I’m jumping back into mail now or jumping back into land now. Um, and really getting up and running and psychologically, it’s kind of hard to.

Cause I like took off and now I got to like ramp back in, like ramp back up. Um, but, but getting back into it, uh, with, with some new strategy.

Ron: Yeah. And the nice thing about it or not, maybe not the nice thing, whatever the thing about it is one thing we’ve been coaching Mike one on one, uh, since he started essentially a monthly calls, whatever they are bi weekly calls and.

During the time, like when Mike, Mike came to us, he’s like, I need to essentially what Mike did. He came to us a few months ago and he’s like, I need to be more efficient with my time with the land. Essentially. Like he didn’t want to just do the bulk mail and he wanted bigger deals. Like that was the biggest thing we talked about.

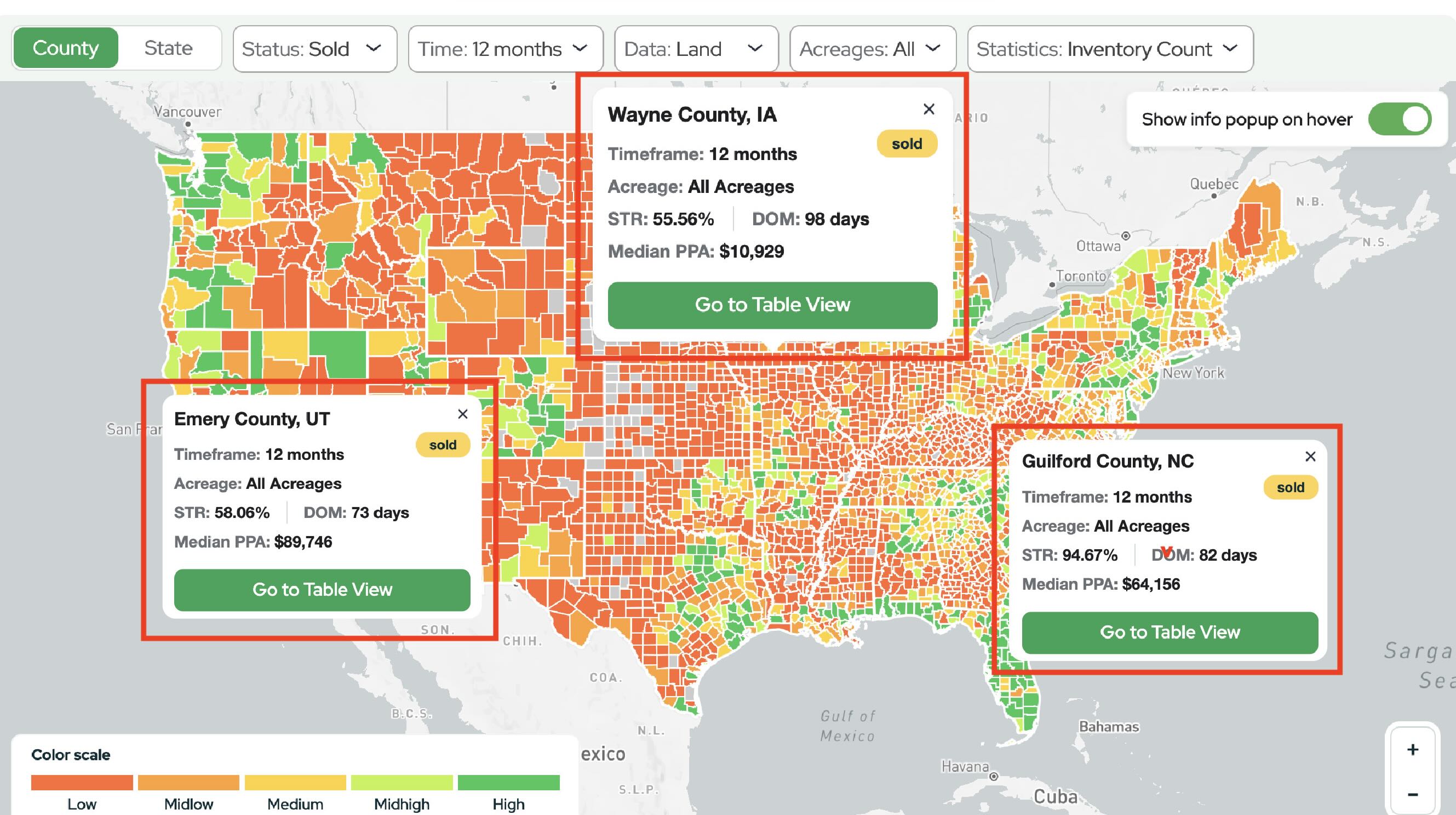

We went to some more expensive areas at first and then. We added some features on the land portal. We’re like, okay, we can change things up completely. Like, let’s go after subdivides, stuff like that. And we probably started that. I don’t know if we started three months ago, whatever, when we first started sending mail out and talking about that.

But you’re kind of like a guinea pig in this. Like, I want to see if we can scale coaching with helping people do big deals for sure. Like once they’re six, 12, 18 months in, like let’s try to do big deals, subdivide deals, more specified deals. And. I don’t know if guinea pigs are right thing, but we were very aggressive.

The pricing talk about that kind of mindset shift from let’s just send five, 10, 000 mailers out a month to let’s send, I don’t know what it is. A thousand a month, but very, very targeted.

Mike: Yeah. It’s definitely different because. It. Yeah, it, it, it’s all about efficiency and it’s all about hitting those big deals.

It’s everything takes more time when you’re targeting, targeting the bigger, bigger deals, but it, it’s much more about efficiency. Whereas before it was, I had the mindset like, gotta get the mail out. Gotta get the mail out. And I don’t, I never did 10,000 ’cause I always had a full-time job. I was doing about 6,000 mm-Hmm.

six to seven. Yeah. 6,000 or so. And it was, it was like, okay, gotta get the pricing done this weekend so I can get these 3000 mailers out. It was all about hitting the mail numbers. Mm-Hmm. . Which I don’t think is bad, but it, it is a complete shift now to, to efficiency. Uh, spending more time on pricing, focusing on going on big Subdivides.

Um, and then even when you get the big subdivides, they are a lot more time consuming. Mm-Hmm. than, than a a buy 30. Sell 70.

Ron: I think it’s good timing for this interview. ’cause you just bought your first big, like a big, big a pretty solid, I don’t know, big, big. I don’t know what what I mean by that. But you bought a pretty solid size subdivide.

Mm-Hmm. . Talk about that deal a little bit that you just literally bought yesterday. Right.

Mike: Yeah, we close on. They said the wire didn’t go through. It might be closing today, but Yeah, either yesterday or today. Or today. Um, so that is, that’s 144 acres and, uh, bought it for, for about 300,000, a little bit over and we’re subdividing it into 13 parcel parcels.

Um. Yeah. And we’re going to, we have, I have a survey out there today. He started on Monday. Uh, he’s he’s he’ll have the perimeter survey done next week. And then we’ll do the split after that, which won’t take that long. And we’ll start selling them.

Ron: People are going to be really interested in this. Cause this is really interesting.

And how much do you think 144 acres is worth? As is

Mike: About what we bought it for.

Ron: So we’re buying for market value, essentially. Um, we’re splitting 300, 000, 144 acres. We’re splitting into three, 13 parts. And I’m saying we, I’m not, I didn’t fund this deal. Um, but, uh, how much road frontage did it have? 6, 000 feet.

6, 000 feet of road frontage. And that’s the key. Like that is the key to everything. And it wasn’t, that’s the thing. It wasn’t perfect land. Like it had, Uh, it wasn’t completely flat by any means, like there’s some areas like you, you cannot just have this be the only road frontage because this is too slow.

So you had to be strategic as, you have to be strategic as far as making sure the parcels are nice buildable parcels each. Um, but yeah, let’s just kind of break down this process. So you got this phone call, when did you get this phone call about this 144 acres? Probably about five weeks ago. So five weeks ago, you’re buying it just today.

So, and did you offer 300, 000? Was it a blind offer? Offered 285. Okay.

Mike: Uh, offer 285. He’s. He said, I think he wanted three 30 or something left out there. It’s like the best I can do is two 85 and then hung up, called him back the next day and said, Hey, how about, would you, would you go up to three? Would you do 300?

And he said, uh, three Oh five. So he said, okay. Three Oh five. Um, so, so that was, I want to say that was about five weeks ago. It negotiated with Asian. Wasn’t that, I mean, yeah, it pushed it up to market value though. Negotiation. That’s what I usually call them back the next day, leave it a little bit just so I don’t seem desperate when I’m buying things.

Um, and then from there, started looking for funding. Once I got funding secured, which also on these deals, it’s harder. Getting funding is definitely a challenging thing.

Ron: Before that, you tried to assess it to make sure, correct? Oh, yeah. Sorry. Did you assess the parcel for like what you think you can get?

When he first called when I first talked to him, okay, so you first talked to him You probably reach out to us and like I have this parcel and I would definitely get in the funding Yeah, but you want to you’re buying something for 305. You’re gonna have survey expenses stuff like that How are you doing this as far as trying to determine what market value we’re buying it for market value But what is the market value when it’s 13 parcels or whatever you split into like what did that process look like?

Mike: I, I started looking at it myself, um, drawing some maps up, uh, looking at the market value for the different acreages that we’d be looking at, you know, what’s five acres, what’s 10 acres, what’s 15 acres worth. Um, I did it first myself, and then I sent it to you guys, I think, and then I sent it to you guys initially, and then you guys reviewed it in one of your calls, um, and basically determined it, it would be about, I think about 575 all said and done, um, But yeah, I started analyzing myself and then went to you guys and asked you guys what your opinion was and got a few other opinions.

Ron: So do you think 5 75 is like worst case scenario for this? Or you think that’s a solid, or would you be happy with 5 75?

Mike: Yeah, I, I think five 50 to 5 75.

Ron: Yeah. And it’s not bad. You’re gonna be all in for what, three 15? About yes, about three 15. Okay. So let’s get into the deal funding part. So you kind of, so it’s not doubling your money.

It’s buy for three 15, sell for two or five 75, five 50, whatever you, and there’s going to be closing costs. Every parcel, all 13 parcels are going to have closing costs. First off, when you kind of, were there any keys when you’re trying to maximize that market value that you did? Some people, I don’t, I don’t know.

Some people, Just were there any keys when you’re trying to maximize your market value? Each market’s different. Some markets are going to be like, all right, five acres is selling really fast. It’s selling really expensive. 20 acres is selling for not that much. Um, I need to try to get as many smaller parcels.

What did that look like?

Mike: Yeah, it is trying to get as many smaller parcels between five and 10 or even five and 15 acres. Cause once you get up 20 plus, uh, in this county, the price breakers really seems to drop, which isn’t always the case. Like we were just looking at a county. In Georgia, where the price per acre over 20 acres is like is massive.

But in this particular County, when you start getting the higher acreages, there’s like a pretty steep decline in price breakers. So we’ve trying to keep them as compact as possible, not. We do have to have probably two parcels about 20 acre over 20 acres a little over 20 acres Um, but trying to get more, you know as many 5 to 15 acre parcels as possible

Ron: Yeah, I think that’s key you got to know the market that you’re getting you got to be strategic with this You don’t want to have too high of expectations.

I think and this was a slower market, too Let’s let’s back up a little bit to kind of market selection You go into markets understanding the restrictions on this and let’s talk about this Restrictions like what did this county say? You can and can’t do?

Mike: Yes, uh, one of the, since I’ve been targeting subdivides, one of the most challenging things I’ve, I’ve had is finding good counties, finding counties where the, the restrictions are low.

So that, that’s taken up, um, a lot of, a lot of time doing research, calling counties, see what you can do, see what you can’t do. This particular county is very nice. It’s, if you have, every parcel needs to be at least five acres with 50 feet of road frontage. And if you follow those rules, you can split as many times as possible.

So that’s, it’s one of the easiest counties. Yeah. That’s mostly most lenient counties.

Ron: And you knew that when you went into it?

Mike: Yes. I mean, yeah, I, I’ve actually done true in this county. I’ve done, uh, the quote unquote, traditional mailing, uh, without not targeting subdivides. I’ve had deals there.

Ron: So you actually did a deal this size, right? A big one.

Mike: No, a small one. I did like a five acre.

Ron: Okay.

Mike: But, but I already knew this county’s restrictions because I’d done deals there and I’ve already talked to zoning. .

Ron: Interesting. Do you think, so how did we, I know we did it together. How did we come up with a 285, 000 offer price? We have, when we’re doing it, we have road frontage as a column.

So 144 acres with 6, 000 feet of road frontage is going to be priced different than 144 acres with 2000 feet of road frontage, right? Yeah.

Mike: Yeah. So, so, so the pricing is, is, um, basically we’re, we’re changing all the acres, we have acreage ranges, pricings, and then road frontage ranges. So we might have 10 to 15 acres with a thousand to 1500.

Uh, feet of road frontage, 10 to 15 acres with 1500 to 2000 feet of road front. And we have so the spreadsheet’s a lot bigger and we have we’re breaking down by both acreage and by Uh by road frontage. I think the everything over 100 acres Um, so we were pricing everything and then you were looking at it And you said just do two thousand dollars for everything over 100 acres two thousand dollars an acre Just throw it out there.

You’ll be able to make something happen

Ron: I wonder if that would be a good county for survey hacking I know that’s kind of going in something different just with something that Unrestrictive, um, I’d be interested where you can fund some of those deals yourself. Uh, do you think that 285 talking to the guy, like he was trying to negotiate, you got, you guys were both playing the game as far as like negotiating.

Do you think that 285 offer was the reason he called?

Mike: Yes. It had to be close.

Ron: Yeah.

Mike: It had to be. If it wasn’t close to what he wanted, Yeah, he would not have called.

Ron: Like this guy was sitting on a 144 acres in a county that’s pretty rural, like 144 for 300, 000 is pretty rural if that’s market value. Um, but he was sitting on this 6, 000 feet of road fringe.

He gets these offers for 000. He’s not calling them back. He doesn’t care. Maybe he’ll bullshit them and shoot them a, uh, 400, 000 offer, but he knew you were close. So like if you could come up with something in the middle, relatively close, um, I think that’s what, I mean, I would imagine that’s why that offer price worked out and how many mailers did you send to this county?

Do you know I know you don’t know exactly

Mike: I want to say like 700

Ron: Okay, and you you have so you had this deal 300k sell for 570, which is crazy We price that really well mike not to not to like toot my own horn. Um, but we price right at 50 Yeah percent of max value essentially Um, but, uh, you said earlier you had one other solid deal that you’re not sure yet on.

Mike: Yeah, I’ve, I’ve basically moved on from it, but I could still, I’m gonna, yeah, I’m a little overpriced on it. So I think we also did the, how much was that? That was like 300. That was around 300 acres. 300, probably 305 acres. And we offered 615, 000

Ron (2): And you think it’s worth?

Mike: He accepted 615, 000. And I called him back and was like, Man, I messed up the pricing, can you do 525, 000 Is there any way?

And he just, he just held it. 615, 000. Um, now you, you looked at, you thought we’d maybe be 1. 1 million. 1. 1 million,

Ron: But that’s a scarier County. Cause it’s a little slower too.

Mike: Yeah, it’s not. It is.

Ron: I don’t know if you want to be selling slow, but it’s yeah, it, the thing is like in some of these rural counties, you will run out of buyers.

Like buyers will be, there’s only so many people that want to go to some areas. Um, so that’s, what’s like, I don’t know if you want to be selling 40 parcels or whatever it is. You have 13 here and then another 25 with that deal. Um, it, it might get a little nerve wracking with that. And, um, That’s interesting.

So is that one of your concerns with this deal? As far as I know, we reviewed it for funding and margins were a little tighter for how we do things, but is what’s your thoughts on sell through? You have a year contract for deal funding. We don’t have to get into too much of the details with that. Um, but is, is that something you’re looking more into now as when you’re picking counties is the speed.

Mike: Yeah, for sure. Um, yeah, this County, I don’t want to say it’s slow. I mean, I, I sold five acres in this County. It’s one five acre parcel went under contract within a week. Uh, it was nice land though. I’m not concerned. I think it’s going to sell. It’s not all going to sell in two months, though. It’s going to take time because we are, we have, we’re breaking out a lot of, we’re going to have parcels that are competing with each other.

And it is, it is a rural area. So it’s not really a concern. I just, I think our expectations, we know. You know, it’s not something that’s going to, we’re going to start, I think things will start selling right away, but to sell everything, it’s going to take some time.

Ron: Yeah, for sure. It’s 13 parcels. That’s a lot.

Um, so. When you split these up, what, what are the, what are the acreage ranges? You said it needs to be at least five acres, correct? Um, what are the acreage ranges? Not exactly what acres, but you start, I’m sure you have some five acre properties, uh, and then how big are the biggest ones?

Mike: The biggest is, Uh, I probably in 25. 2025.

Ron: Yeah. And the reason like 13 parcels, 144 acres we’re averaging 10 acre per parcel. Uh, you, I’m sure you would’ve split it more if you could have, but like you do run out of road frontage at some point. I’m not saying this parcel is weird because. There there’s not weird, but there’s some slopes. So you need to keep in mind all these things when you’re subdividing who Mike.

So you obviously have done some one on one coaching with us, stuff like that. You’ve also done some coaching and helped some people as well. Um, you have done a lot of land deals. Who do you think this is for? Cause we talked about before this podcast, before we hit record about like, there’s a lot of moving pieces with this.

Do you think subdivides like this are a little more advanced?

Mike: I do. I, I, it’s not something I would start with once you, once you have a good understanding of the land, but I mean, it doesn’t hurt to try the thing. The thing is, it’s so efficient. You know, if you sell, if you pull 600 pieces of data, sound out 550 mailers, you know, it’s not that expensive.

It’s very efficient. So you could do it. Um, but I’d recommend having a little bit more experience. Um, maybe once you’re a year in, if you want to try it six months, I don’t want to stop people from trying it, but it’s, it’s more, the pricing’s harder. Yeah. I told you the county, even getting, once we were under contract, um, the zoning restrictions.

It took, I probably called them 10 to 15 times over a few week period. Yeah. Just to make sure because they weren’t certain. They told me those, um, those restrictions, but then they weren’t certain about it. And I just had to stay on top of them because I mean, their government employees, you know, the difference between like an entrepreneur that wants everything fast and a government employee that kind of is taking their time.

So I just stay on top of them. Um, and they actually appreciate it. They said, just keep calling me back until I do it for you. So eventually got them. Um, so anyway, but the, um, the pricing is a little bit harder. The zoning stuff’s harder, funding’s a little bit harder, it’s more complicated on the disposition side.

So everything’s just more complex and it’s substantially more time consuming. I’ve never put this much time in a deal. Like this is way, yeah. Yeah, it’s a lot more time consuming. Which is fine, I mean, it’s great money for the amount of time, I’m not complaining about that. But everything is a little bit more, everything is a little bit harder.

Ron: And like this is a big one too. It’s not like you’re splitting 10 acres into two, five acre parcels. You’re splitting 144 acres into, uh, 13 parcels. So looking at 2025, Mike, like, are you trying to do one of these deals every two months? What, like, what in your mind, like, looks like a good 2025 to you? Like you need, you’re running droners.

So you got, like, you got to balance your time and everything like that. So you get to be efficient with this stuff. Um, but from a land perspective, like, what do you, like, Envisioning what are your goals for 2025? As far as you don’t need to do a deal every month. I don’t think.

Mike: Yeah. Yeah. That’s a good question.

I’ve gone back and forth on this. Um, the balancing, the two businesses is hard, um, especially cause they’re not that related. So there’s the context switching and it’s, um, yeah, it’s tough. Uh, so I’ve, I’ve been going back and forth. I think, I mean, I think reasonably doing this on the side. Uh, cause really droners is the number one priority right now, but doing the side, I, I want to make a half a million dollars next year, net profit from land.

Ron: I mean, it’s like you’re not gonna have any expenses, you know what I mean? Like there’s, there’s no expenses. You sent 700 pieces of mail to get this deal, which is whatever, 400, 500. You have some data. Like, let’s just say you spent 700 to get this deal. You’re going to make a hundred thousand dollars on worst case scenario.

You make a, I think worst case scenario, you make a hundred thousand dollars. Um, So you do, and this is like, I don’t want to say this is the lowest end of this strategy, but it’s definitely far from the highest end. What barriers do you think you have of like doing a 500, 000 deal versus buying like that 600 buy for 600.

I don’t know if it’s self for 1. 1, but if it was in a better market, like it would look a lot more intriguing for sure to you and sell through it’d be much better, but what’s keeping you from being able to do a buy for 500 sell for a million is just the leads or what is it?

Mike: I got, I need to get more mail out.

That’s that’s, um, yeah, I’m going to have to put more focus on this. Um, and that’s the whole balancing the two businesses at the same time, but it’s just going to be more consistent with mail. And part of it is it’s, it’s psychologically getting back in the mindset of doing mail regular or doing land regularly, because I took off a few months, like I said, in that, in that period.

So it’s, it’s getting back into it, um, full force. But I, I think the, the barrier is just me not being consistent enough. What about deal funding? Yeah. I mean, that’s going to be tough. I think if the deal is good enough, I can get funding though. Yeah. I think I’d figure it out. But yeah, the deal funding is, is also, I mean, you’re buying something market value.

Most of the deal funders. that and it’s a lot of money. So you’re, you got to sell, you have to sell and it’s there. So you’re selling something that’s legitimate, but you have to sell, like we’re buying this for market value, but look at what the price per average price per acre is when we subdivide this into 10 parts.

Ron: Yeah. It’s buying a house before a renovation, essentially. Like it’s, it’s a lot of stuff. Like you have a. Uh, ARV maybe adjusted retail value, something like that after improvements. I don’t know what it’s called in that industry. Um, but that being said, like you have an improvement and this is an improvement you’re doing now you’re selling 13 parcels.

And each one has X value. Yeah. Um,

Mike: I would say one more. And the funder that I’m using, the funder I found, he’s been doing land investing longer than I have. So he’s bringing his own expertise. Yeah. And he’s helping me too. Like he’s bringing his own opinions, expertise. He’s kind of giving me a, um, different advice on the split.

So it’s, it’s, that’s very nice for the, especially this being my first big one, having another land expert working on it with me. Um, that’s been very helpful.

Ron: Yeah. Um, what advice would you have someone like you’ve been in this industry a long time? You’re doing it differently right now than when you first started, which a lot of people make adjustments and they grow.

Um, and now you’re doing something very specialized. What would be your advice for someone looking to get into this business with a nine to five? You had a nine to five. You had a family when you got started. So you have a different situation than Landon who is sitting in that seat than Dylan that I just talked to.

Um, what would be your advice for someone coming in?

Mike: Yeah, That’s a good question. Um, Yeah, I would come in fully committed, uh, come in with, uh, I don’t know what you guys say about how much money to bring in. I’d say bring in five to 10, 000, um, and just fully commit to it. Even if you’re fully committing into it part time, you know, I’m committing 15 hours a week to this business.

I’m going to, I’m going to learn. I’m going to show up. I mean, those call the calls you have are very helpful, especially the Wednesday, the deal review, you learn so much about analyzing land, um, by, by being on those calls. So I would say I would recommend fully committed. Don’t, uh, don’t get caught up in one mailer, you know, get out, get out as many mailers you can.

Um, and I think you’ll like the results.

Ron: Yeah. And how, how was that like balancing work family? You had a, when you started, you had a kid, um, you were obviously working a job. Like how was the balance? Is it just kind of just having like a set time for, I know we’re back enough to 2022 again. Um, just having a set time for everything.

Yeah. Yeah. This is when I’m doing land.

Mike: Well, it is that, and it’s just getting it in whenever I can.

Ron: Yeah.

Mike: Like, after I’d put my daughter to bed, I’d start working.

Ron: 100%.

Mike: Work at night. It, yeah, yeah, I did have set times for it. But then also, um, and my wife was good. I’d work a lot of Sundays, um, like all the, a lot of the days on Sundays.

And my wife would, you know, hang out with the kids or do whatever. Take the kids somewhere. Um, so giving me that freedom because she believed in it as well. Uh, but yeah, it’s having the set times and also getting in whenever you can.

Ron: What would you be doing if it wasn’t for the land portal like not like just like realistically like if you didn’t have that data Do you think you would still be doing land?

I don’t know. You know what I mean? Like yeah, it’s like being able that’s why you got the deal You know, I mean like you’re not sending out unless you have a VA handpicking, but they’re not gonna know exactly 6, 000 feet of road frontage Yeah, it’s very It’s crazy that you can predict like pretty accurately what the end market value is just because you have the road, like we are predicting how much you can, how you can split 144 acres into 13 acre parcels and you can, you know, this before you send your mail out.

Um, But yeah, I was just curious, like, I don’t know if you’d be doing land to be honest, from my perspective, uh, because it is like, it’s a high volume thing when you’re not being, which is fine for a lot of people and it works for a lot of people. Um, but when you can be more targeted, it makes you more efficient.

Mike: Yeah, I, I don’t know. That’s a good question. Whether I would have, um, started if I stayed in land, I definitely would have started texting more. I would have changed the game, but I would have changed my strategy and adapted. But. Yeah. I don’t know. I might not be doing land.

Ron (2): Yeah.

Mike: Because this is fun. I like this a lot.

And it is very efficient with,

Ron: And it’s like a next step. Like you want to, you start doing land deals, buying for 15, selling for 30, buying for 20, selling for 40, 45. Like that’s fun. That’s amazing. You’re making good money. Um, but like, how do I advance this? How do I make more money on each deal? How do I become a bigger expert?

Cause you might, you might go from these minor subdivides to major subdivides to entitlements. Like there’s so many different steps taking the next level. And as you add these different skills. Split into 13 acres or 13 parcels is a skill in itself. Learn how to manage that deal, and then you just keep on leveling up your skills in the business.

Um, but yeah, I, I, I, I didn’t know what you were gonna say to answer that question. I don’t know what it was, honestly. It’s interesting to think about. Yeah. Um, but yeah. Mike, I appreciate you coming on talking about land. I know you talked about drones, um, a few days ago. We, that should have been up. If you guys haven’t watched that, make sure you watch that.

Anything else for the viewers?

Mike: No, I mean, I, I think for, for, um, for, for the new land investors, I, I, or people that are interested in land, I really recommend giving it a shot because it changed my life in multiple ways. Even, um, you know, I’ve been doing it for multiple years now, but the reason I could quit, you know, we bought, I bought this, this company droners.

io, which is on a previous podcast. We talk about it, but the reason I could quit my job and go all in and droners. io is because the money I made from land. So whether you want to be a full time land investor or you want to build up capital to do other things, um, or you want to go into land investing and then go into different niches of land investing, like I’m doing as well, um, just get started.

Cause there’s so many different routes and there’s a lot of people that have started with land investing and gone into different niches and made so much money to be made.

Ron: It’s crazy how many people and Daniel was talking to someone the other day who’s like an expert entitlements in our community. Um, there’s so many different, like everyone starts at like same spot and they just kind of spread out there doing their own niches.

Some people are doing very, very expensive. There’s just so many different things. I can’t get into it all. Um, but yeah, if you guys, Mike’s on discord, if you guys have any questions for him, I’m sure he’d be more than happy to answer. Um, but appreciate YouTube, hit the subscribe button below, like this video, leave us a comment, uh, let us know what you think.

Spotify or Apple. Leave us a review, uh, leave us a comment. I believe you can do that in there now as well. Thanks so much. We’ll see you next time.

Dan: As always, thank you for joining. Please do us a huge favor and like, and subscribe our YouTube channel and share this with a friend. It really means the world to Ron and I, but more importantly, it could help change the life of someone else.

Thanks for joining and we’ll see you next episode.